ENVIRONMENTALLY FRIENDLY AND TRUSTED MARKET INFRASTRUCTURE

FN-EX-550a.3

A market’s effective functioning and appeal are determined by its infrastructure , which should ensure high-quality and accessible information for end-users, brokers, and investors; reliable barriers to deter market manipulation and conflicts of interest; smoothly operating IT systems; and the ability to process substantial flows of information between issuers and providers of capital.

Cybersecurity is an integral part of Moscow Exchange Group’s risk management strategy and system. Measures taken to enhance information security ensure that the quality of management systems and the reliability of infrastructure are in line with global best practices.

This section describes measures that Moscow Exchange Group takes to ensure business continuity, including the reliability of information, data confidentiality, availability of operations, and information security.

Moscow Exchange Group’s objectives and the UN Sustainable Development Goals

- SDG 9.b Ensure sustainable financial infrastructure

2023 highlights

For data from 2021, 2022, and 2023, see the subsection “Environmentally friendly and trusted market infrastructure” of the section “Sustainability Data”. For the key policies, procedures, and responsible departments, see the subsection “Environmentally friendly and trusted market infrastructure” of the section “Sustainability Approaches and Procedures”.

Risk management

3-3 2-24

The overall risk management system aims to guarantee reliable infrastructure. In 2023, Moscow Exchange Group continued to implement the

The Group’s progress towards achieving the goals and objectives established in the strategy is monitored regularly: status reports are submitted to collegial executive bodies for review. We also use KPIs to assess the effectiveness of the risk management system.

As part of the Strategy and Roadmap, Moscow Exchange has implemented an approach to determining its risk appetite. The component risks carry equal weight and are deemed to be material for the Group and all its companies.

Moreover in 2023, the Roadmap for the Risk Management System Development Strategy for 2024 was updated.

ESG risk management

2-24

The expectations and interests of the Group’s stakeholders align with Moscow Exchange Group’s high level of preparedness for new ESG risks and opportunities. Approaches to identifying priorities and opportunities are determined based on the company’s strategic goals and objectives.

By analyzing key sustainability trends, risks, and opportunities at an early stage, the company can enhance its strategic performance. Prioritizing key economic, environmental and social issues as risks and opportunities is an integral part of Moscow Exchange Group’s operations and internal processes.

In the reporting year, Moscow Exchange Group achieved all its goals and objectives. This lays a solid foundation to further develop the risk and opportunity assessment process with respect to sustainability.

Emerging risks are identified systematically, and the business units responsible for managing the risks detected are designated during the identification phase. For each risk, a management strategy and mitigation measures are developed in accordance with the risk management system. Each risk is controlled and monitored.

201-2

Climate-related risk management

In 2023, Moscow Exchange continued to develop the climate risk and capacity management process in line with the TCFD Recommendations, finalized the integrations of climate risk into the unified risk management system.

The following climate risk and opportunity management tools are regularly used:

- assessment of the risks and opportunities associated with climate change;

- training employees to anticipate likely events and threats

The short-term horizon (12 months) includes an annual review of transitional and physical climate-related risks, as well as regular monitoring of the conditions and legal framework for identifying them. Moscow Exchange incorporates international practices for identifying and assessing climate-related risks into its operations.In the reporting year, all the tasks and goals set for the Moscow Exchange Group within the framework of the climate

- preparation of reports for disclosure of information under the TCFD;

- implementation of climate risk monitoring metrics;

- dissemination of climate risk management principles to Group companies;

- conducting scenario analysis according to NGFS (Network for Greening the Financial System) scenarios;

- educational events for issuers on climate risk management risk management system.

Moscow Exchange Group is expanding its partnerships with various institutions in order to disseminate knowledge and expertise. It is developing models for identifying and assessing climate-related risks. More information on TCFD initiatives can be found in the 2023 Moscow Exchange Climate Report.

Emerging risks are identified systematically, and the business units responsible for managing the risks detected are designated during the identification phase. For each risk, a management strategy and mitigation measures are developed in accordance with the risk management system. Each risk is controlled and monitored.

Information security

FN-EX-550a.3

Moscow Exchange Group continues to implement its information security programme for the years 2021-2024. The projects under way will help to maintain the Group’s development pace and level of reliability.

The Group’s companies have electronic and computer crime and personal liability insurance policies to mitigate operational and information security risks.

FN-EX-550a.1

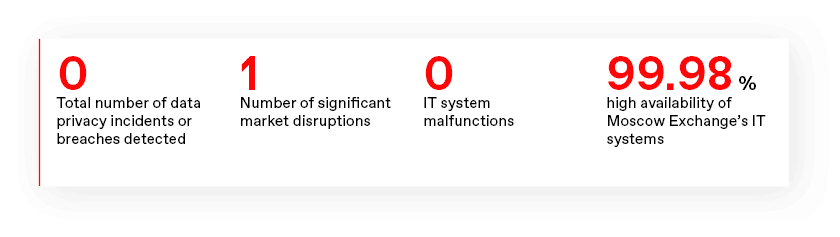

In 2023, MOEX there was no failures that led to the suspension of trading due to implementation of information threat risks

On 13 September 2023 Moscow Exchange detected abnormal operation of the trading and clearing system (TCS) of the derivatives market (from 08:50 to 11:27). The cause of the emergency situation was an error in the operation of the derivatives market TCS core during the morning trading session.

Robust IT infrastructure

In 2023, the Group continued to implement measures to maintain the required level of system reliability. For example, a new disaster recovery data centre was commissioned and relocating systems from the current backup data centre began.

As part of the software and hardware updates programme, multiple tests of equipment and software from Russian providers were carried out, providing MOEX with a large number of reliable suppliers for further system development tasks.

Infrastructural reliability remained at 99.98%.

Data governance activities implemented in 2023:

- development of the previously implemented operational model for data quality management to minimise risks (reputational, regulatory, operational) and increase the level of satisfaction of business users with data services;

- development of flexible methodologies for testing and implementing data monetisation tasks.

Access to products and services

FN-EX-550a.3

Moscow Exchange continues to provide investors and market participants with equal and unhindered access to its products.

In 2023, work continued on developing clients’ personal accounts. Clients will be able to sign contracts and submit applications via a single interface, which vastly improves the client path.

Finuslugi.ru

The Group continues to develop the Finuslugi personal finance platform by connecting new financial service providers and expanding its product line. In the future, new types of people’s bonds, loans and other products from banks, asset managers and insurance companies will become available on the platform.

The year 2023 saw the following significant updates to the Finuslugi platform:

- The first issue of Moscow green bonds took place

- an additional issue of Kaliningrad bonds;

- an investment rating for private investors and a credit rating were developed;

- a catalog of brokers and mutual funds was created.

Registrar of Financial Transactions

The Financial Transactions Registry (“FTR”) was launched in 2019 in conjunction with the launch of the Finuslugi platform. Created on the basis of NSD, the FTR accumulates information on all transactions made on any financial platform.

MOEX Treasury platform

In 2020, Moscow Exchange launched MOEX Treasury, a terminal for corporate clients with direct access to trading. MOEX Treasury allows bidders to perform transactions on Moscow Exchange markets through a single user-friendly interface, including:

- conversion and swap transactions on the FX Market;

- deposits with a central counterparty on the Money Market;

- hedging opportunities on the Derivatives Market;

- deposit auctions in the M-deposits segment.

MOEX Treasury also provides integration with bidders’ personal accounts, as well as access to the Transit 2.0 system, which is an advanced platform used by banks and corporations to exchange financial messages and electronic documents The solution is based on NSD’s Electronic Data Interchange (EDI) system.

In 2022, a new convenient model for providing access to the MOEX Treasury terminal was

Spectra platform

The Spectra platform provides futures and options trading. A second pricing model was introduced in 2022, providing negative-pricing trading and a mechanism for switching between models.

High-speed market data feeds

In October 2021, a new high-speed derivatives market data feed, SIMBA SPECTRA, was rolled out. The service allows clients to receive market signals faster than all previously available connectivity methods.

The service speed is ensured by a newly-established software interaction between the SIMBA SPECTRA gateway with the central component of the trading system and a high-speed segment of the network infrastructure designed specifically for transmitting large volumes of data to multiple recipients in real time.

The new service implements the Public Data First principle and eliminates the need to use multiple sources simultaneously to obtain market signals. The protocol is based on the modern Simple Binary Encoding, which significantly speeds up the process of obtaining and processing market data by clients’ trading algorithms. Similar technologies are successfully used at the largest exchanges worldwide, supporting the trend of development of high-tech client trading systems.

The new service, combined with the TWIME trading protocol, delivers an optimal IT solution for clients whose trading strategies are extremely sensitive to the speed of market data feed and order entry latency.

In October 2022, Moscow Exchange introduced new high-speed market data distribution protocols SIMBA ASTS in the Equity & Bond and FX Markets. The new service is an in-house development of the Exchange and is intended for banks, brokers, algorithmic and high-frequency traders, which co-locate their equipment in the Exchange’s data centre.

The main advantages of the service are:

- speed which is far superior to all existing protocols;

- unified message formats;

- an ability to quickly assess movements of the best prices;

- a dedicated high-speed network infrastructure in the colocation area.

Access protocol for FX and Equity & Bond Markets

October 2022 also saw the launch of FIFO TWIME ASTS, a new access protocol for FX and Equity & Bonds Markets that significantly accelerates the delivery and processing of trade orders compared with the previous FIFO MFIX Trade protocol.

The new service is able to transmit orders to the trading system without waiting for a response on the processing of a previous order (asynchronous order delivery), making trading more convenient for high-speed traders. Strict first-in-first--out (FIFO) compliance improves the transparency and predictability of the exchange’s IT infrastructure.

- the Information Security Strategy for

2024–2028 was approved - RUB 0 in financial losses resulting from failures of the information security system and cybersecurity;

- no breaches involving personal data leakage or disclosure of confidential information.

Plans for 2024

In 2024, Moscow Exchange plans to:

- review the supply chain and software and hardware updates;

- adapt the technological landscape and infrastructure to the revised strategy;

- introduce new risk management tools, including systems that incorporate machine learning and scenario analysis;

- train staff on anticipating probable events and threats;

- analyze financial and non-financial risks integrated in the risk map;