ADVANCED PRACTICES OF RESPONSIBLE INVESTING

Global trends show that investment companies and financial institutions have been transforming their investment strategies. Issuers’ commitment to the principles of sustainability is becoming an important factor in choosing recipients of investment. As a participant of the Sustainable Stock Exchanges (SSE) initiative, Moscow Exchange upholds the principles of responsible investment and creates opportunities to expand sustainable practices in Russia.

Reliability of information on issuers

FN-EX-410a.3

Moscow Exchange’s stance is consistent with international practice regarding the public disclosure of information by listed companies; financial, production, and ESG data; and changes that may affect share prices.

3-3

In 2023, Moscow Exchange updated its Listing Rules, which define the conditions and procedures for placement on the financial platform, the rules for delisting various types of securities, and other important details. According to this document, the inclusion of securities on the quotation list is subject to the following requirements:

- compliance of the securities with the current legislation of the Russian Federation, including regulatory acts of the Central Bank of Russia;

- registration of a securities prospectus (securities prospectus, privatization plan registered as a securities prospectus) if, in accordance with the legislation of the Russian Federation, such registration is required for public circulation of securities;

- assumption by the issuer of the obligation to disclose information in accordance with the requirements of the Law on the Securities Market and other legal acts of the Russian Federation, including regulations of the Central Bank of Russia.

- assumption by the issuer of Russian depositary receipts certifying ownership of a certain number of securities of a foreign issuer, certifying rights in relation to shares or bonds of a foreign issuer, the obligation to disclose information about the issuer of foreign shares or bonds in accordance with the requirements of the legislation of the Russian Federation on securities.

Moscow Exchange conducts a review of securities for which applications have been submitted, checking issuers’ compliance against Moscow Exchange’s listing requirements. When preparing an expert opinion, the Listing Department considers official documents received by Moscow Exchange, information disclosed or submitted by the issuer, and messages posted on the websites of competent (regulatory) government authorities and organisations (self-regulated organisations, settlement depository, ratings agencies, organisations specializing in expert review of environmental and social projects, etc.). It may also consider information from the media and other sources.

Moscow Exchange monitors the compliance of market participants’ activities with the listing requirements. Should a violation of these requirements be detected, Moscow Exchange reserves the right to set a deadline to rectify it or to delist the securities.

NCC is guided by the Rules of Clearing on the stock market, the deposit market, and the loan market.

In 2021, the Central Bank of Russia published an information letter containing recommendations on disclosure by public joint-stock companies of non-financial information about their activities: companies are recommended to voluntarily disclose information on sustainability and ESG factors—including corporate governance — as well as environmental and social performance. Moscow Exchange supports the initiatives of the Central Bank of Russia.

Sustainability sector

3-3

In cooperation with the Ministry of Economic Development of the Russian Federation, in 2019 Moscow Exchange launched the Sustainability sector, a special sector for trading target-oriented securities.

Objectives of the Sustainability sector:

- help companies, public authorities, and other issuers raise funds for environmental and social projects;

- create an environment conducive to foreign investment in Russian bonds;

- offer a set of instruments for funding initiatives that meet the objectives of national projects and comply with Decree of the President of the Russian Federation No. 204 of 7 May 2018 “On National Goals and Strategic Objectives of the Development of the Russian Federation to the Year 2024”.

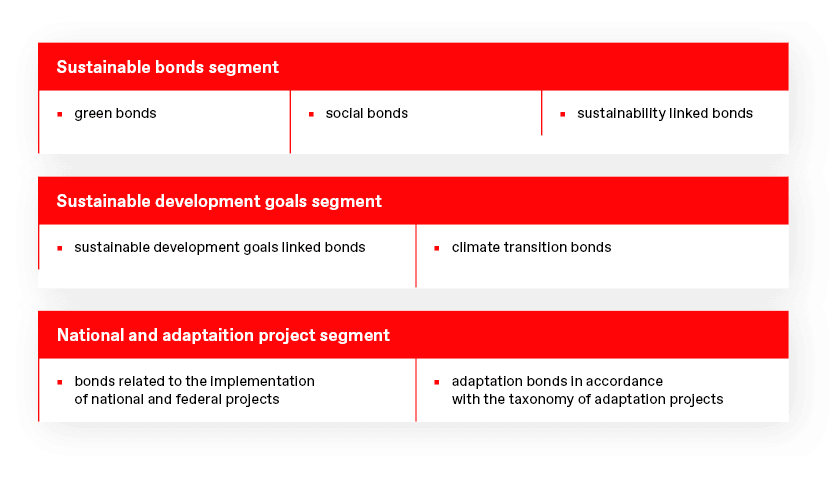

In 2023 the Sustainability sector consisted of following segments:

- Sustainable bonds segment, that includes green, social and sustainability linked bonds;

- Sustainable development goals segment, that include sustainable developments goals linked bonds, and climate transition bonds;

- National and adaptation projects segment.

Principles for including bonds in the Sustainability sector

FN-EX-410a.4

Segment | Requirement | Disclosure requiremnets |

|---|---|---|

Sustainable bonds segment |

|

|

Sustainability linked bonds segment |

|

|

National and adaptation projects segment | For national project bonds:

| report on the intended use of funds; |

identification of the “adaptation bonds” issue in accordance with the Securities Issuance Standards;

|

Listing rules

In order to be considered for inclusion in the Sustainability sector, an issuer must submit the following:

- an application for inclusion in the sector;

- a certificate from an external verifying body;

- a statement that the issuer undertakes to disclose information (no less than once a year throughout the lifetime of the bond) confirming that the funds raised are being put to appropriate use;

- for the national and adaptation projects segment: a statement by a government body, official, or interdepartmental committee confirming that the offering, the issuer, or the investment project are consistent with the objectives and results of one of the national projects.

Key documents:

- Listing Rules of Moscow Exchange

- Social Bonds Principles (SPB)

- Green Bond Principles of the International Capital Market Association, (ICMA), 2018

- Climate Bonds Standard of the Climate Bonds Initiative

- VEB.RF Taxonomy (VEB.RF National Methodology for Green Financing)

- Taxonomy of adaptation projects (Resolution of the Government of the Russian Federation of September 21, 2021 No. 1587).

- Listing Department

ESG indices

3-3

The Responsibility and Transparency Index and the Sustainability Vector Index are calculated in accordance with the partnership agreement signed in March 2019 between Moscow Exchange and the RSPP. The purpose of the partnership agreement is to develop and booster sustainable business practices among Russian issuers, improving their investment appeal and helping them become more transparent and trustworthy for investors.

The composition of the indices is reviewed annually through an RSPP analysis of the reporting of major Russian companies. The indices are released daily on the websites of Moscow Exchange and the RSPP, as well as through various news agencies.

In February 2023, the Moscow Exchange, in partnership with the RAEX agency, began calculating new equity indices in the field of sustainable development - the Moscow Exchange Index - RAEX ESG balanced and the Moscow Exchange Index - RAEX ESG balanced total return.

The index calculation base is formed once a year based on the list of issuers of shares admitted to trading on the Moscow Exchange and occupying leading positions in the ESG ranking of the RAEX agency. Index values are published on a daily basis on the Exchange website, and are also broadcast through news agencies.

Key document:

- Methodology for Calculating Moscow Exchange ESG Indices

- Methodology for calculating the Moscow Exchange Index of Russian Corporate Eurobonds “

RSHB – RSPP – Vector of Sustainable Development”, 2020; - Methodology for calculating Moscow Exchange share

indices – RAEX ESG.

- Indices and Market Data Department

ESG ETFs

3-3

ESG ETFs build their investment strategies and determine their asset structure based on the relevant sustainability stock indices of Moscow Exchange. By purchasing units of ESG ETFs, investors gain access to a diversified portfolio of the most successful Russian companies that comply with sustainability principles. Investors can manage the units independently. ETFs are the most popular securities with retail investors across the world.

Key document:

- Rules for Trading on the Equity and Bond Market of Moscow Exchange

- Equity Market Department

Growth sector

3-3

In 2017, Moscow Exchange launched the Growth sector.

The purpose of the sector is to help promising small and medium-sized enterprises raise capital. The primary objective of the sector is to facilitate the implementation of the national project “Small and Medium-sized Entrepreneurship and Support of Individual Entrepreneurship Initiatives”. The sector already has a mature ecosystem that includes:

- a set of rules of entry to the sector, including a risk management system for vetting companies;

- a set of partners (development institutions);

- a network of professional service organisations;

- government support tools;

- a specialized project team within Moscow Exchange which is experienced in working with SMEs.

The Growth sector of Moscow Exchange is supported by the government, per Russian Government Decree No. 532 dated 30 April 2019, which provides for partial compensation of the costs of issuing shares and bonds and the costs of agreements on assignment of a credit rating.

Measures to support companies in the Growth sector include:

- subsidies of up to 70% of the coupon rate;

- compensation of up to RUB 2.5 million for the issuer’s costs on placement of the securities;

- anchor investments from SME Bank, with an option to act as the co-organizer of the offering;

- guarantees and endorsements for SME Corporation’s bond offerings (up to RUB 1 billion);

- help from the territorial divisions of the Central Bank of Russia in organizing events for issuers;

- waived listing fees for SMEs placing bonds of up to RUB 400 million up to the end of the year;

Listing rules

Listing rules for SMEs.

The issuer must have been established at least three years prior to the issue.

The issuer must have revenue of at least RUB 120 million. The maximum revenue must be less than RUB 10 billion for bond issuers and less than RUB 25 billion for issuers of shares.

For bond issuers:

- the minimum issue volume is RUB 50 million;

- there must be an assigned rating or support from development institutions (guarantees from the SME Corporation, anchor investments from SME Bank).

Priority is given to:

- SMEs;

- companies showing growth in financial results;

- industrial companies;

- companies with export revenue;

- companies that have received support from the SME Corporation, SME Bank, FRP, REC or RDIF.

Company screening and risk management

Companies that wish to join the Growth sector must meet a number of criteria. Each new issuer must undergo KYC (Know Your Customer) procedures that include a review by experts from Moscow Exchange departments who check each applicant against a set of risk parameters. If the review reveals any potential risks, the issuer’s file is forwarded to the Growth Sector Board Committee, which then makes a final recommendation.

Many small and medium-sized businesses joined the Growth sector after receiving support from our partners, such as guarantees and endorsements from the SME Corporation, anchor investments from SME Bank, or a subsidized coupon rate (which significantly reduces the likelihood of default).

Innovation and Investment Market

3-3

The Innovation and Investment Market of Moscow Exchange was launched in 2009 to attract investments to the innovative sector of the Russian economy.

Key documents:

- Rules for Classifying Shares and Bonds of Russian Organisations, as well as Investment Units Circulating on the Organized Securities Market as Securities of the High-tech (Innovative) Sector of the Economy (approved by Russian Government Decree No. 156 dated 22 February 2012)

- Managing Director for Relations with Issuers and Authorities

- Committee for Development of the Innovation and Investment Market

- Innovation and Investment Market Coordination Council

Listing rules

Key listing requirements:

- market capitalization of at least RUB 500 million;

- business areas: telecommunications, internet, software, development and production of semiconductor devices, biotechnology, pharmaceuticals, high-tech, knowledge-based technologies, new materials, energy efficiency, etc.;

- credit rating assigned to the issuer and/or its bond issue by one of the approved ratings agencies;

- securities prospectus drawn up in line with Russian laws and information disclosure standards;

- investment memorandum containing detailed information about the company’s financial and operational activity and the main goals and plans for delivering potential growth.

The innovative segment requires the involvement of a listing agent (i.e., an advisory, broker, or investment company accredited by Moscow Exchange).

Measures to support companies in the IIM sector:

- marketing and promotion programs for issuers conducting an IPO/SPO;

- attracting investors targeting companies of the given type;

- IR services and tools: presentations for investors, roadshows, webinars;

- information and analytical coverage based on monthly IIM reports;

- access to pension savings: according to Central Bank of Russia Regulation No. 580-P, up to 5% of the portfolio of pension savings of NPFs can be invested in shares of issuers included in the IIM-Prime segment;

- tax incentives for investors.

Carbon unit market

The Exchange believes that the creation of a voluntary market for carbon units is one of the key steps towards creating real economic incentives for decarbonisation projects as part of the Russian Federation’s commitments under the Paris Climate Agreement, adopted on 12 December 2015 by the 21st session of the Conference of Parties to the United Nations Framework Convention on Climate Change. The project is also important to maintain the competitiveness of exporting companies. The transition to a low-carbon economy requires an interim adaptation phase, where climate projects serve as an emissions regulation tool. Their implementation results in generation of carbon units, which market contributes to the harmonisation of economic relations between the commodity market players subject to international agreement on the rules of the new turnover mechanisms.

3-3

Key document:

- The Federal Law No. 296-FZ of 2 July 2021 On Limitation of Greenhouse Gas Emissions provides for the creation of a registry of carbon units to be operated by a legal entity authorised by the Government of the Russian Federation.

After addressing the issue, the Ministry of Economic Development and Trade of the Russian Federation together with Moscow Exchange have proposed to establish an infrastructure for the operator of a carbon accounting registry. The operator was established on the basis of Kontur JSC, the existing legal entity.

In the framework of setting up a carbon unit registry operator the Exchange will have the following tasks:

- assisting the operator in supporting the operational processes of the operator’s platform;

- participating in the development of methodological and regulatory documents regulating the operator’s operational processes, interaction with registry customers, as well as with state bodies and international organisations;

- developing proposals for the operator’s participation in carbon unit trading and implementing such proposals together with other parties.

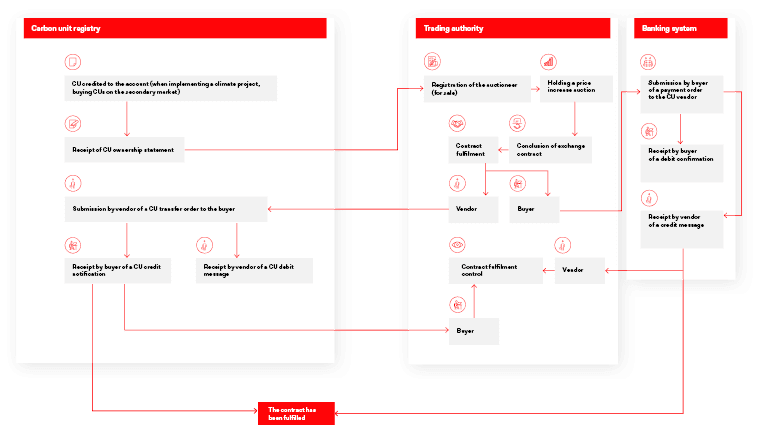

Carbon project and carbon unit registration process

A set of measures providing for the reduction (avoidance) of greenhouse gas emissions or their increased absorption can be a climatic project. The project shall meet the following criteria to be recognised as a climatic project:

- to be consistent with the federal and regional law on the territory of the project implementation and to be carried out pursuant to the documents of the national standardisation system for limited greenhouse gas emissions;

- not to result in increased greenhouse gas emissions or their reduced absorption outside the project;

- to be supplementary related to the measures targeting the fulfillment of mandatory requirements of the Russian law effective as of the start of the project;

- not to be a result of reduced production;

- the reduction (avoidance) of greenhouse gas emissions and/or their increased absorption within the project implementation period shall not be a result of factors unrelated to the project activities;

- climate projects include low-carbon energy, resource conservation, efficient waste management, sustainable agriculture, and reforestation projects.

The project shall be registered in the carbon unit registry prior to its actual implementation.

In order to issue carbon units into circulation, it is necessary to:

- register the climatic project in the carbon unit registry;

- send an application for the issue of carbon units from the personal account of the Public Services (Functions) Portal of the Russian Federation with the following documents attached to it:

- a document certifying the powers of the climatic project manager, contractor or other authorised person, who has signed the application for the issue,

- a verification report,

- an application for the issue with enclosed documents shall be signed with an enhanced encrypted and certified digital signature and sent to the operator;

- upon receipt of the notification of the issuance of the carbon units, submit an order to credit the carbon units to the account of the climatic project contractor;

- pay the service.

Carbon unit and Quota fulfillment unit

The carbon unit is a verified implementation result of the climatic project expressed as a mass of greenhouse gas equivalent to one tonne of carbon dioxide.

The quota fulfillment unit is a verified fulfillment result of the set quota expressed as a difference between the set quota and the actual mass of greenhouse gas emissions equivalent to one tonne of carbon dioxide.

Climatic project verification

The project verification is a process of evaluating and verifying the calculation of the number of issued carbon units. To be carried out by a person accredited by the Russian Federal Service for Accreditation (RusAccreditation). The report is generated on the implementation results of the climatic project verified in accordance with Part 5 Art. 9 of the Federal Law - On Limitation of Greenhouse Gas Emissions, with a positive opinion of an accredited person on the verification of the climatic project implementation results (verification report).

The verification report shall be submitted together with the application for the issue of carbon units.

Carbon unit sale in a commodity auction

To effect the sale and purchase of carbon units in a commodity auction the vendor shall provide the Exchange with an extract from the carbon unit registry issued to the applicant/bidder by the legal entity maintaining the carbon unit registry in accordance with the effective law of the Russian Federation, certifying the rights of the applicant/bidder to carbon units and/or quota fulfillment units of at least 50 units in total.