ADVANCED PRACTICES OF RESPONSIBLE INVESTING

Exchanges contribute significantly to raising capital for improving sustainability. They also play an important role in in creating financing facilities to help modernize the economy in line with climate goals.

As a member of the Sustainable Stock Exchanges (SSE) initiative, Moscow Exchange works hard to develop sought-after financial ESG instruments and promote them among Russian companies, investors, and financial institutions. Moscow Exchange is striving to create a new market segment for environmentally and socially significant projects that are appealing for issuers and investors.

Moscow Exchange promotes responsible investment both as a company and as a provider of financial infrastructure, recognizing that the generation of long-term sustainable returns is dependent on well-governed social, environmental, and economic systems.

Moscow Exchange Group also promotes modern corporate reporting requirements, thereby contributing significantly to more transparent markets. The Exchange has developed infrastructure to foster a local investor base, and it provides access to funding for innovative companies, as well as small and medium-sized enterprises.

FN-EX-410a.3 3-3

Moscow Exchange requires issuers to disclose the following information that may affect stock prices:

- changes related to the company’s financial health;

- major corporate transactions, including restructurings, mergers, and acquisitions;

- changes to the management team;

- positive or negative material information on issuers’ products and services;

- legal or regulatory changes affecting the issuers’s ability to conduct business.

The grounds for suspending trading in securities are set out in the Listing Rules of Moscow Exchange. The decision to suspend trading in securities is made by Moscow Exchange on the basis of an expert opinion issued by the Listing Department. The Exchange contributes significantly to increased transparency of disclosures through its requirements for issuers.

3-3

As part of the work of the Bond Issuers Committee and user committees, the Exchange performs regular analyses of feedback from customers and market participants about new ESG products; it also works to increase their awareness on such topics.

Moscow Exchange Group’s objectives and the UN Sustainable Development Goals

- SDG 8.3, 9.3 Increase growth opportunities and access to financial markets for small and medium-sized enterprises

- SDG 8.10 Develop financial infrastructure for better access to capital markets, promote the development of a local investor base

- SDG 9.1 Increase access to financial services for retail investors

- SDG 9.b Increase growth opportunities and access to financial markets for companies that develop innovative products

- SDG 12.6, 12.8 Improve the quality and quantity of ESG information disclosed by issuers

- SDG 12.6, 13.3 Develop instruments to promote responsible investment

Major highlights in 2023

For comprehensive performance metrics for 2021, 2022 and 2023, see the subsection “Advanced practices of responsible investing” of the section “Sustainability Data” For the key policies, procedures, and responsible departments, see the subsection “Advanced practices of responsible investing” of the section “Sustainability Approaches and Procedures”.

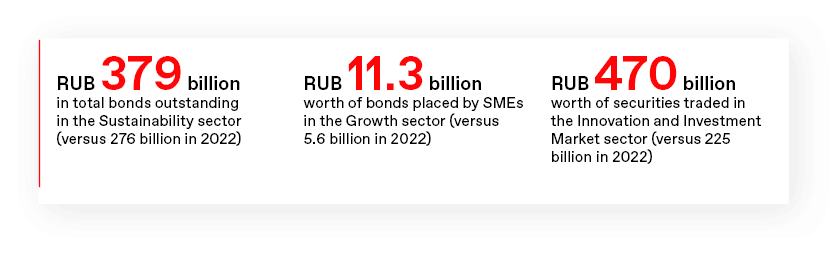

Sustainability sector

203-2

In 2019, Moscow Exchange Group established the Sustainability sector to help issuers raise funds for environmental and socially significant projects . The Sustainability sector consists of four segments: green bonds, social bonds, sustainability bonds (as of 2021), and a segment for national and adaptation projects. For more details on the Sustainability sector and its core listing rules, see the section “Sustainability Approaches and Procedures”.

In 2023, changes were made to the Listing Rules of the Moscow Exchange, as a result of which a new Segment of bonds related to sustainable development goals appeared in the structure of the Sustainability Sector, and the range of instruments was expanded: climate transition bonds and bonds related to sustainable development goals were added.

Currently the Sustainability Sector is composed of the following segments:

- Sustainability bonds (green, social, sustainability);

- Sustainability linked bonds

- National and adaptation projects

In 2023, PJSC Rosbank and DOM.RF (IA) placed the first two issues of sustainable development bonds in the Sustainability Sector in the amount of 33 billion rubles.

The creation of such sector is in line with the global best practices and represents one of the most important steps for Moscow Exchange as part of the UN initiative of Sustainable Stock Exchanges (SSE). About 130 exchanges take part in the initiative with only 53 of them currently having such a listing category.

As more and more investors prefer sustainable projects targeting the improvement of ecology and social environment, the Russian business is increasingly thinking about corporate social responsibility and application of the ESG principles in their operations. The sustainability sector will provide for proper positioning of issuers and investors with the targeted nature of investments.

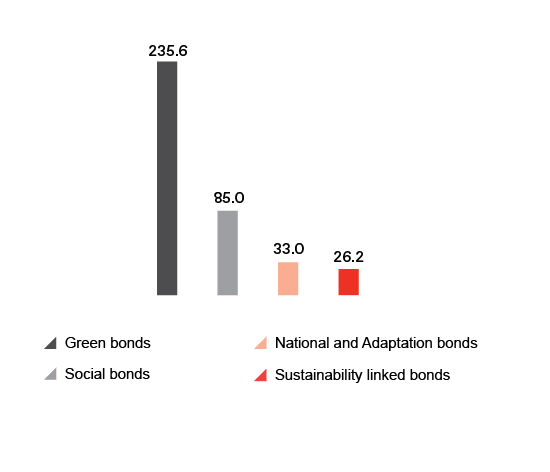

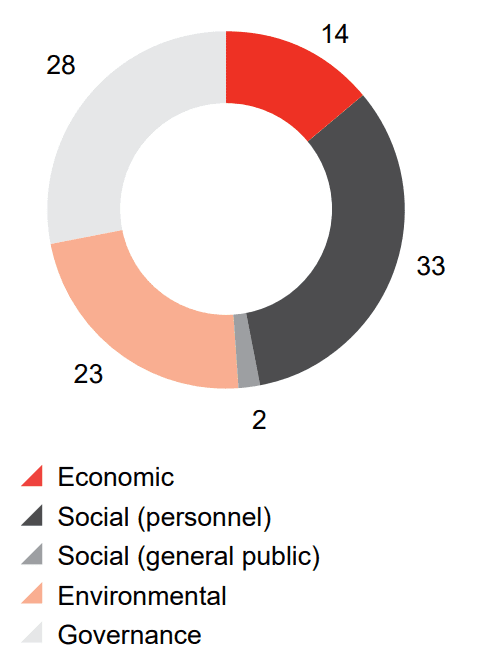

In 2023 32 issues of ESG bonds of 17 issuers were in circulation in the Sustainability sector, including 19 issues of green bonds, 5 issues of social bonds, 2 issues of sustainability bonds, 5 issues of national bonds and 1 issue of adaptation bonds.

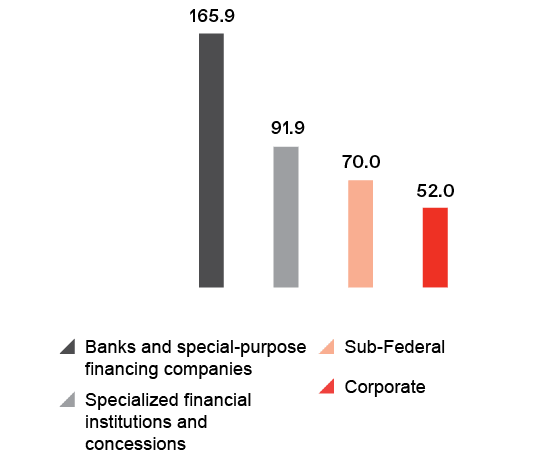

Bonds in circulation in the Sustainability sector by bond type as of the end of 2023 and structure of issuers

Sustainability sector structure

In July 2023, the Board of Directors decided to create the Sustainability Sector Council to support the implementation of the Russian Federation’s Green Finance and Sustainable Development Policy, raise investments to finance ecology, environmental protection and socially important projects, and to develop and further improve the Sustainability Sector.

The Council comprises representatives of development institutions, relevant business associations and other interested organisations that have expert knowledge in sustainable development and responsible finance, as well as verifiers of financial instruments for sustainable development, the Ministry of Finance of the Russian Federation, the Ministry of Economic Development of the Russian Federation and the Bank of Russia.

The main task of the Council is to coordinate the MOEX Group, government authorities, development institutions, verifiers of financial instruments of sustainable development and other interested organisations for the development of on-exchange instruments for raising investments to finance ecology, environmental protection and socially important projects.

The Council held its first meeting in December 2023 to discuss how to create incentives for the sustainable finance development.

Building a market for trading in carbon units

The carbon unit register operated by Kontur JSC has been functioning in Russia since September 2022.

The carbon unit is a verified implementation result of the climatic project expressed as a mass of greenhouse gas equivalent to 1 tonne of carbon dioxide.

30 November 2023, another large on-exchange auction for carbon units was held. SIBUR acted as the seller and auction client. Two purchase and sale deals for a total of 2,735 carbon units were concluded at the close of trading. The purchasers were a subsidiary of Gazprombank and Carbon Zero. Weighted average selling price was RUB 700 per carbon unit.

The carbon units were generated through the climate project implemented at SIBUR-Khimprom to reduce greenhouse gas emissions from dioctyl terephthalate production. The change in technology reduced NG consumption per unit of output.

An interest is currently being observed in registering carbon units by Russian companies implement. Companies, which strategies include achieving carbon neutrality, are also interested in the carbon market as a means of reducing their carbon footprint.

Growth sector

203-2

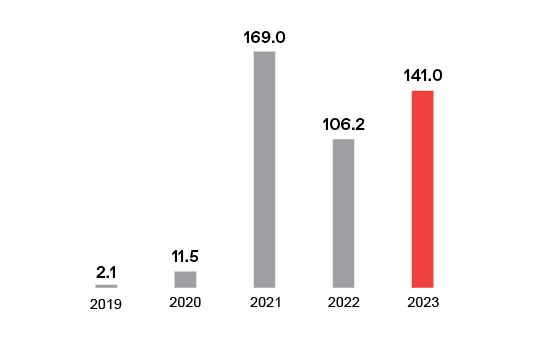

In 2023 MOEX Group extended access to funds for small and medium-sized enterprises (SMEs) in the Growth sector, thereby facilitating their growth.

The Growth sector of Moscow Exchange was created for public offerings and for circulating the securities of promising small and medium-sized enterprises (for a detailed description of the sector and its listing rules, see the section “Sustainability Approaches and Procedures”).

To be included in the Growth sector, bonds need a credit rating of at least BB- on the Russian scale.

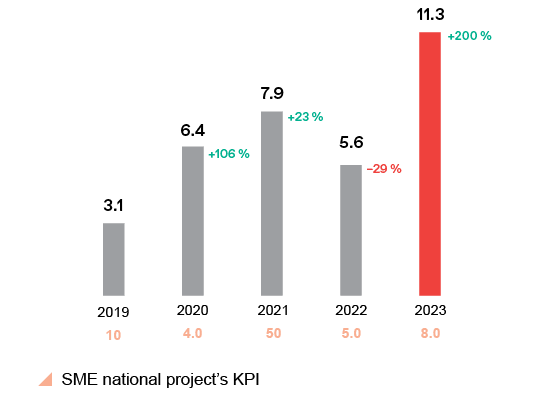

As of 31 December 2023, 2 share and 67 bond issues of 40 SMEs were traded in the sector. The total volume of SME bond placements amounted to RUB 11.3 billion.

- 69 securities:

- 67 bonds

- 2 shares

- 40 SME issuers

- RUB 11.3 billion were raised by SMEs in the form of bonds in 2023

In 2023 19 SME issuers placed 28 bond issues and raised 11.3 billion RUB of debt financing (+200% y-o-y, in 2022 the total amount of SME placements was 5.6 billion RUB). To subsidize listing preparations, 47 issuers received coupon-interest income subsidies with the total amount of subsidies exceeding RUB 725 million.

3-3

In order for issuers of SMEs from high-tech industries to receive a tax benefit in addition to support within the framework of the National Project “SMEs and Support for Individual Entrepreneurial Initiatives,”, the Moscow Exchange in the new edition of the Listing Rules (came into force on 06 March 2023) abolished the restriction on the simultaneous inclusion of securities in Growth Sector and IIM Sector.

As a support measure, Moscow Exchange Group has improved accessibility to the bond market for SMEs by waiving charges for listing bonds for flotations of up to RUB 400 million. The grace period was extended up to 31 December 2024.

Innovation and Investment Market

3-3 203-2

The key goal of the Exchange’s Innovation and Investment Market (IIM) is to promote investment to the companies at the innovation sector of the Russian economy.

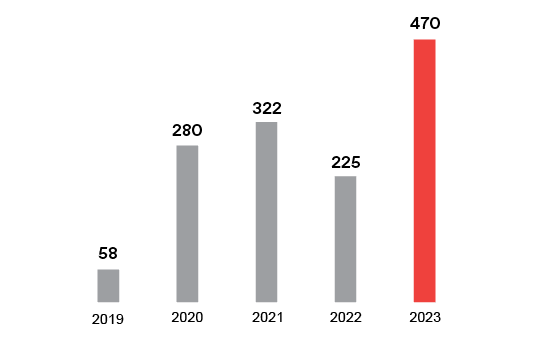

By the end of 2023, 31 securities were traded on the Innovation and Investment Market (IIM) sector, including 10 shares, 19 bonds, one exchange-traded fund (ETF), and one closed-end pre-IPO fund. The total capitalization of the sector amounted to about RUB 630 billion. The trading volume exceeded RUB 470 billion.

In 2023 IIM held seven placements of bond issuers (PA UOMP JSC, PROMOMED DM LLC, VUSH LLC, Selectel LLC, Carsharing Russia LLC (2 bond issues), Softline JSC) with a total volume of issues of 28 billion RUB, as well as the IPO of PJSC CGRM Genetico (transaction volume 179 million RUB) and SPO of PJSC Softline (transaction volume 3.5 billion RUB). IIM issuers include companies from the following industries: biotech and medical technologies, internet and media, IT and telecommunications, and innovative technologies.

To encourage high-tech companies to list on the stock exchange, the following types of government support are available:

- tax relief on income from the sale or other disposal of shares and bonds of Russian entities, and of investment units that are securities from the high-tech (innovative) sector of the economy, provided that they have been continuously owned by the taxpayer for at least one year prior to the date of their sale;

- the tax incentive applies to share transactions in high-tech companies with maximum market capitalisation of RUB 75 billion, bonds of issuers with maximum annual revenues of RUB 75 billion, investment units (maximum net asset value (NAV) of RUB 75 billion);

- as part of the initiative “

Takeoff – From Startup to IPO”, approved by the Russian Government in 2022, small innovative enterprises will be eligible for grant support to co-finance innovative projects, with the grants to be provided by Federal State Institution Foundation for Assistance to Small Innovative Enterprises in Science and Technology. Each grant is capped at RUB 30 million; part of that amount may be spent on listing (legal support fees, investment banking services, marketing, and other services).

ESG indices

203-2

FN-EX-410a.4

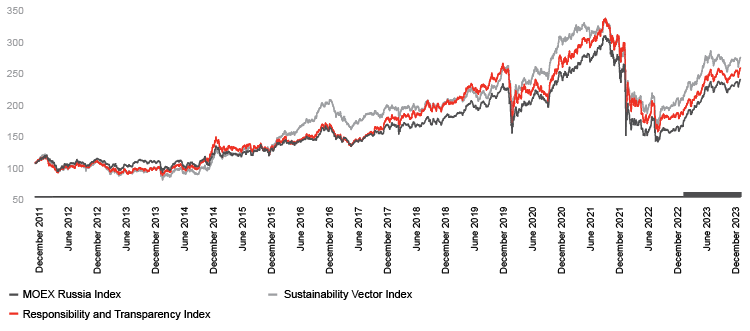

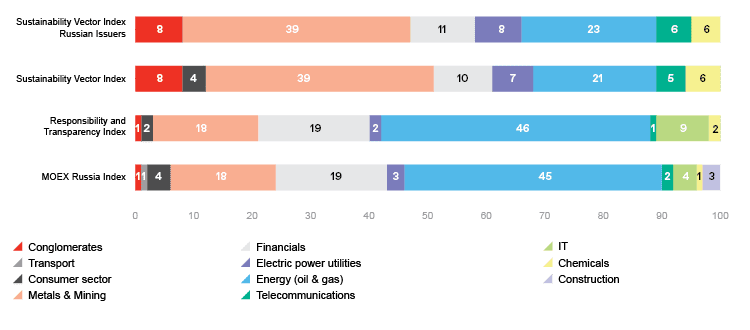

Moscow Exchange Group calculates and tracks Russia’s first sustainability indices. This is a joint project with the Russian Union of Industrialists and Entrepreneurs (RSPP). The MOEX-RSPP ESG indices help reveal a correlation between the quality of disclosures on responsible business practices and the yield dynamics of issuers’ stocks.

3-3

Each year, RSPP evaluates reports and ESG indicators of companies with considerable market capitalization operating in Russia. Moscow Exchange stock indices are based on this evaluation, as well as their derivatives, which create the basis for ESG ETFs . Since January 2021 Moscow Exchange has been listed on the RSPP Responsibility and Transparency Index and the Sustainability Vector Index.

On February 27, 2023, the Moscow Exchange began calculating and publishing a new index of shares in the field of sustainable development “Moscow Exchange Index - RAEX ESG Balanced” (code - MESG).

Moscow Exchange’s sustainability indices

- Moscow Exchange’s sustainability indices

- MOEX-RSPP Responsibility and Transparency Index, MRRT (calculation is based on the stock prices of 29 issuers);

- MOEX-RSPP Sustainability Vector Index, MRSV (calculation is based on the stock prices of 24 issuers);

- MOEX-RSPP Sustainability Vector Total Return Index (calculation base includes companies with the best sustainability indicator dynamics, taking into account reinvestment of dividends);

- MOEX-RSPP Russian Companies Sustainability Vector Total Return Index (launched in 2021 based on the stock prices of 22 issuers);

- MOEX RSPP — RSHB Russian Corporate Eurobonds ESG Index (launched in 2021; based on the Eurobond loans of Russian corporate issuers listed on the MOEX-RSPP Sustainability Vector Index. The calculation of this index was temporarily stopped in April 2022).

- Moscow Exchange

Index – RAEX ESG balanced. The calculation base for the new index includes 15 shares of companies that are leaders in the RAEX ESG ranking. The calculation base is formed once a year based on the list of issuers of shares admitted to trading on the Moscow Exchange with leading positions in the ESG ranking of the RAEX agency. The index is calculated and published daily.

A new version of the Sustainability Vector Index, the MOEX-RSPP Russian Companies Sustainability Vector Index. The methodology factors in regulatory requirements for non-state pension funds, making it possible to invest pension savings in a basket of index-linked securities or a financial product whose underlying asset is the new indicator.

FN-EX-410a.4

ESG ETFs

As of the end of 2023, the number of ETFs on the ESG indices of the Moscow Exchange amounted to five funds:

- ESGR ETF RSHB-MOEX-RSPP VecTR (ESGR);

- ESGR ETF RSHB-MOEX-RSPP Russian ESG Eurobonds (PRIE);

- SBRI ETF Responsible Invest (SBRI);

- WIMF ETF Russian Equity ESG (ESGEG);

- ETF “Technologies of the Future” by “Sistema Capital” Management Company (SCFT)

ESG guidelines

203-2

FN-EX-410a.4

Education and information of financial and commodity markets participants on the ways to integrate the ESG principles into the companies’ operations is an important mission for stock exchanges all over the world. Moscow Exchange meets that role by organising a conference sessions and webinars, as well as by supporting similar events of its partners.

The first Guidelines for Best Sustainability Practices (ESG Guidelines) published in 2021 by Moscow Exchange was positively received by issuers seeking to follow the sustainability principles. That is why a decision was made in 2022 to update the ESG Guidelines in order to reflect modern ESG trends. In particular, the updated ESG Guidelines included the description of the market for exchange trading of carbon units, the latest trends towards harmonisation of non-financial reporting and the specifics of the non-financial and climatic information disclosure, as well as new aspects of corporate sustainability through the biological diversity support and supply chain management. In addition, the ESG Guidelines were supplemented by detailed instructions on how to prepare for the release of ESG in the Sustainability Sector.

Moscow Exchange believes that the ESG Guidelines may be used as a benchmark in the course of developing or improving corporate sustainability strategies, which will contribute to improving the quality of company management. The fact that some 300 participants joined the presentation of the ESG Guidelines proves its importance for the Russian market.

Access to transactions with national bonds

In December 2021, the Finuslugi platform introduced the first service for the purchase and sale of national bonds of the constituent entities of the Russian Federation. Regional securities with guaranteed income will be sold only on the Moscow Exchange platform; a brokerage account will not be required. National bonds are not only a tool for increasing the financial literacy, but also a way to implement ESG projects: in particular, using the funds raised, water bodies will be cleaned, landfills will be reclaimed, and urban improvement projects will be implemented.

On May 30, 2023, the Moscow Government began placing the first issue of green bonds on the Finuslugi platform. The bonds were issued in the amount of RUB 2 billion with a circulation period of two years. The minimum investment amount is RUB 1 thousand. The circulation period is 728 days (until May 27, 2025). The coupon rate is 8.5%, coupon period is quarter (91 days). The funds received from the bond placement will be used to finance Moscow environmental programs. Moscow citizens will be able to participate in the replacement diesel buses with electric buses to reduce pollutant and greenhouse gas emissions from vehicles.

On July 27, 2023, the fourth issue of bonds of the Kaliningrad region was placed on the Finuslugi platform. The funds raised, as in previous issues, will be used for the development and improvement of cities and settlements in the region. The nominal amount of the bonds is RUB 1 thousand. The coupon income rate is constant (9.5% per annum). Coupon payment is quarterly. The total volume of the bond issue amounted to RUB 500 million.

Consumer lending and insurance service

In 2023, Finuslugi’s client base grew by more than 70% and reached 1.9 million people. The number of banks on the platform has grown to 25, the number of insurance companies to 20. Finuslugi are represented in 82 regions of the Russian Federation.

The range of products on the Finuslugi platform is represented by bank deposits, cash loans, MTPL insurance and mortgage insurance policies, as well as national bonds. On the platform in 2023, more than 20 new products and services were implemented: savings accounts and deposits, a catalog of brokers and mutual funds, as well as investment rating for private investors and credit rating.

Plans for 2024

In 2024, the Group plans to keep improving its responsible financing practices:

- continue to develop the Sustainability sector; extend the ESG index family; creating the Sustainability sector index, improve the non-financial reporting practices of issuers, and continue activities to popularize the ESG agenda;

- stimulate the increase of the number of climate projects that have registered carbon units with the Russian operator Kontur JSC;

- host more educational events for issuers and market participants to share knowledge and experience in ESG management and responsible investment;

- improve the Group’s own ESG practices and sustainability reporting system;

- meet KPIs of the volume of placements by the SME under the national SME projects.