TRUSTED RELATIONS WITH LOCAL COMMUNITIES

Financial literacy improvement activities

3-3 203-1 203-2 413-1

Improving the financial literacy of novice investors is a priority of Moscow Exchange Group’s ESG strategy. By pursuing this objective, Moscow Exchange can make a significant contribution to achieving sustainability goals.

Investing is an active form of participation that professional portfolio managers, traders, and the public engage in to develop the modern economy. This includes green financial instruments, which have not only an environmental, but also a social effect. Successful ESG transformation of financial markets largely hinges on the availability of training for market participants.

In order to make investing activities more attractive for individual investors and raise their awareness of the ESG agenda, Moscow Exchange conducts specialized activities, training seminars, and competitions, as well as large-scale financial education projects. It also organizes contests to demonstrate the benefits of an informed approach to trading.

- The Moscow Exchange School has been running since 2014. The materials, video courses, and webinars published on the project’s web page help novice and experienced investors understand the stock exchange and how to settle trades effectively and with confidence.

- The Investor’s Path training course. Moscow Exchange has developed a free training course for novice investors based on the methodology of the International Organisation of Securities Commissions (IOSCO); the course is accredited by the Financial Literacy Association.

- The Best Individual Investor contest has been held since 2003 and is the world’s largest exchange competition for traders.

- Moscow Exchange is the general partner of Fincontest, or the All-Russian Financial Markets Knowledge Contest, which has been held annually by the Financial University under the Government of the Russian Federation since 2009.

- Moscow Exchange Group supports projects of the Central Bank of Russia and the Russian Ministry of Finance to develop financial skills and awareness and improve the financial literacy of the public.

The following activities were held in 2023 to improve financial literacy:

- webinars for individual investors;

- contests (Best Individual Investor);

- development and promotion of educational content via the Telegram channels

MOEX – Moscow Exchange and Moscow Exchange School; the Money Makes Money podcast).

Key documents:

- Strategy for the Improvement of Financial Literacy in the Russian Federation 2017-2023.

- Strategy Department

- Business Development Department

- Department of marketing, PR and services

- Equities Market Department

- Issuer Relations Department

Promoting gender balance and equality in the professional community

Moscow Exchange Group is a party to the global Ring the Bell for Gender Equality initiative. Every year on the 8th of March, participating exchanges ring bells at opening or closing of trading as a gesture to promote the principles of gender equality and the empowerment of women in business, politics, and the economy. The main goal of this initiative is to urge businesses to take measures to promote sustainability goals through the empowerment of women. In particular, the role of exchanges involves promoting gender equality among companies whose shares are listed on their floors and in calling for adherence to the Women’s Empowerment Principles (WEP).

Information about Moscow Exchange Group’s adherence to the principle of no discrimination and gender equality in regards to its employees is provided in the subsection “Respect for human rights, equal opportunities and staff engagement” of the Report section “2023 Sustainability Performance Highlights”.

Key documents:

- Code of Professional Ethics of Moscow Exchange

- ILO Conventions No. 111 and 156

- UN Universal Declaration of Human Rights

- Internal Control and Compliance Department

- Corporate Communications Department

Investments in communities and charity projects

203-1 203-2 413-1

Moscow Exchange’s charity activities aim to address important social issues in those areas where it has strong competencies or strategic interests. It also sponsors external projects to strengthen relationships with customer groups and professional and business communities, and also to develop the Russian financial market. The Group’s largest corporate donors are Moscow Exchange and the National Settlement Depository.

In 2023, priority areas of the charity programes included:

- support for education and financial literacy;

- support for Russian medicine;

- helping children, people in need of in difficult circumstances;

- supporting veterans and elderly. supporting veterans and the elderly.

Moscow Exchange has the following priorities for its charitable activities:

- educational initiatives for people of all ages, aimed at improving the financial, investment, and technological literacy of the public;

- support for educational institutions of all levels, educators and students (e.g., through grants and scholarships), research and popular science, and publications in the fields of finance, economics, and technology;

- assisting children, the economically disadvantaged, people who have found themselves in difficult situations (by helping them get back to an active life and find a decent job), and WWII veterans;

- programs that promote stewardship of the environment among companies and individuals; programs that protect biodiversity and encourage the development of renewable energy sources;

- programs that raise awareness among individuals and organisations of the importance of socially responsible behavior and participation in charitable activities; programs that support and develop volunteering;

- o corporate volunteering, i.e., the involvement of Group employees in charity activities, which includes cash donations by employees.

A Charity Committee is responsible for planning, analyzing, and evaluating projects, as well as for issuing opinions and recommendations to the Executive Board and the Chairman of the Executive Board of Moscow Exchange when selecting applicants to participate in charity programs.

413-1

The effectiveness of charitable activities is evaluated using feedback from partners and beneficiaries, obtained through email in the form of a report from the charities involved.

Moscow Exchange cooperates with a number of reputable charitable foundations, thereby ensuring transparency and effectiveness of the allocated funds, while also increasing the number of end beneficiaries.

New projects are considered by the Charity Policy Committee based on the following criteria:

- alignment with Moscow Exchange’s strategic priorities;

- significance in achieving the UN Sustainable Development Goals, national priorities, and other initiatives and partnerships in which Moscow Exchange is a member;

- the positive impact of the charity programs;

- the ability of the beneficiaries to continue to implement qualitative changes after the program’s completion;

- the absence of compliance risks and negative information about the beneficiaries.

Moscow Exchange seeks to ensure that all Group companies act in accordance with the Charity Policy and harmonize the principles and approaches used in their charitable activities with it.

Moscow Exchange does not support organisations that discriminate based on gender, sexual orientation or nationality, nor does it participate, directly or indirectly, in financing organisations whose activities involve human rights violations, the creation or proliferation of weapons of mass destruction, or projects that pose a risk of environmental pollution.

Key documents:

- Regulation on Sponsorship and Financing of External Projects by Moscow Exchange

- Regulation on the Charity Policy Committee

- Regulation on Sponsorship by Moscow Exchange

- Regulation on the Moscow Exchange Sponsorship Committee

- Regulation on the Charity Commission of the National Settlement Depository

- Corporate social responsibility program of NPO JSC NSD for the period

2021–2023 (updated in 2022).

- The Charity Policy Committee of the Moscow Exchange Executive Board

- For charity programs with a budget exceeding RUB 10 million, relevant opinions, proposals, and recommendations are submitted to the Moscow Exchange Executive Board for consideration

Corporate volunteering

Volunteering is an important aspect of the corporate culture of Moscow Exchange Group: it brings staff together by fostering common values. Moscow Exchange employees can participate in partner projects as volunteers or donors.

Employee participation in charity projects is encouraged, including by the use of an internal “currency” (a description of the MEMS project is provided in the subsection “ Respect for human rights, equal opportunities and staff engagement “Sustainability Approaches and Procedures”).

Employees receive information about charity events in the Company News weekly morning newsletter; they can also find about charitable activities on the special Corporate Charity page on the intranet. There, staff can apply to participate in volunteer events, make donations, or post announcements about alternative charitable projects in order to find like-minded people.

Interaction with stakeholders, partnerships, and associations

2-29 413-1

Moscow Exchange Group actively works to build constructive dialogue with Russian and foreign investors, market participants, current and potential issuers, regulators, and professional communities. It pursues this by engaging in direct communication through advisory bodies, working groups, investment conferences, forums, and specialized training events. These efforts help attract new investors to the Group’s markets, thereby expanding the client base, increasing the liquidity of financial markets, and bringing an inflow of investment to the Russian economy.

Many areas of Moscow Exchange’s activities involve interacting with government authorities; these relations are supervised by the Managing Director for Interaction with Issuers and Government Authorities.

Key documents:

- AA1000 AP AccountAbility Principles

- AA100 SES AccountAbility Principles

- Regulation on the Exchange Council

- Strategy Department

- Corporate Communications Department

- Personnel and HR Policy Department

- Chief Operating Officer (COO)

- Managing Director for Interaction with Issuers and Government Authorities

- Head of Investor Relations

The Moscow Exchange Council and user committees

The Moscow Exchange Council is the organisation’s main consultative and advisory body. Its objective is to elaborate strategic proposals for developing the Russian financial market and to represent trade participants and consumers of Moscow Exchange’s services so that their needs can be fully taken into account. The Moscow Exchange Council is made up of members of management of leading market participants, heads of self-regulated organisations, and representatives of management companies, investment banks, and the Central Bank of Russia.

The Exchange Council has the following competencies:

- elaborating proposals and providing recommendations to the Supervisory Board on how to improve Moscow Exchange Group’s development strategy;

- discussing priority projects and selecting at least one project to be used as a KPI for the management of Moscow Exchange, as well as providing relevant recommendations to the Supervisory Board or other competent management bodies;

- developing proposals to improve the exchange’s infrastructure and clearing technologies, and to attract market participants from new client segments and other areas, and providing recommendations to the Supervisory Board or other competent bodies.

Moscow Exchange Group interacts with market participants via user committees. Through these committees, Moscow Exchange Group gathers feedback from clients on planned innovations to products and services, improves its exchange infrastructure, and prepares proposals for amending financial market regulations.

The user committees are advisory bodies made up of stakeholder representatives. Committee members give recommendations to management bodies of Moscow Exchange on its strategic development and operations in certain markets. The user committees and the Exchange Council were created pursuant to Federal Law No. 325-FZ “On Organized Trading” dated 21.11.2021.

As of 31 December 2023, Moscow Exchange had the following user committees:

- Committees created pursuant to legislative requirements:

- Foreign Exchange Market Committee;

- Derivatives Market Committee;

- Repo and Securities Lending Committee;

- Stock Exchange Committee;

- Fixed-Income Securities Committee;

- Deposit Market Committee;

- Credit Market Committee.

- Committees created at the initiative of Moscow Exchange:

- Exchange Council;

- Settlements and Transaction Documentation; Committee;

- Collective Investment Market Committee;

- Share Issuers Committee;

- Bond Issuers Committee;

- Primary Market Committee;

- Index Committee;

- Debt Market Indicators Committee;

- Information Technology Committee.

- Committees under the National Settlement Depository:

- Quality and Risk Committee;

- Committee on Settlement and Depository Activities and Tariffs;

- Committee on Interaction with Registrars and Depositories;

- Central Depository Services Users Committee;

- Repository Services Users Committee.

Most of the committees feature members who are professional market participants: banks, brokers, investment companies, issuers, and non-finance companies. They are appointed for a term of one year.

Members prepare proposals for amending legislation and improving the regulatory framework, and also review issues of regulation of public circulation and issuance of securities, information disclosure and corporate governance. The committees also elaborate proposals for process solutions to improve the organisation of exchange trading, clearing and settlements, and the expansion of tools and services.

For the convenience of everyone involved, Moscow Exchange publishes a monthly user committee digest containing a list of issues considered at meetings of the Exchange Council and the user committees, as well as the decisions taken. Information on the work of the committees is available to the public on the websites of Moscow Exchange and the National Settlement Depository.

Sustainability initiatives and partnerships

2-28

In keeping with its mission and corporate values, Moscow Exchange participates actively in various Russian and international organisations, associations, and voluntary initiatives.

- Moscow Exchange is a regular participant of the Ring the Bell for Financial Literacy initiative of the World Federation of Exchanges. It also participates in the global Sustainable Stock Exchanges (SSE) initiative, which was launched in 2009 at the initiative of former UN Secretary-General Ban Ki-moon. It is a partner program of the UN Conference on Trade and Development (UNCTAD), the UN Global Compact network, the UN Environment Programme Finance Initiative (UNEP FI), and the Principles of Responsible Investment (PRI).

- Moscow Exchange Group participates actively in numerous working groups on sustainable financing and responsible investing together with other market participants and regulators. One example is an initiative to encourage best practices in business ethics, compliance, and anti-corruption by the Russian Association of Business Ethics and CSR (Russian Business Ethics Network, RBEN).

Interaction with market participants and regulators

Moscow Exchange Group holds conferences, roundtable discussions, and seminars involving various partners from the corporate and public sectors. At these events, participants discuss legislative developments, IR trends, and topics pertinent to sustainability.

Key events in the field of corporate governance and investor relations include a yearly annual report competition, which is held by Moscow Exchange together with the RCB media group. The competition contributes to making public companies more transparent and disclosures more useful for investors and customers.

Support for political parties and organisations

3-3 415-1

Moscow Exchange Group maintains a neutral position when it comes to political and religious activities, but it does not impinge upon its employees’ right to choose their own views, nor does it prevent them from pursuing such activities at their own cost and as private individuals. In 2022, the Group did not make any donations to political organisations.

Developing partnerships with institutions of higher education

Moscow Exchange cooperates with leading universities to ensure the availability of high-skilled, well-trained personnel for the Group and the financial industry. It also works to promote the implementation of research projects in the fields of economics and technology.

Moscow Exchange cooperates closely with the Higher School of Economics, the New Economic School, Lomonosov Moscow State University, the Financial University under the Government of the Russian Federation, Plekhanov Russian University of Economics, and the MEPhI National Research Nuclear University. Together with these institutions, Moscow Exchange conducts research on the securities market, IT, and risk management. It creates special software to train young specialists.

Through career guidance programs, students are given the chance to apply for an internship at Moscow Exchange Group in their field of interest. Group employees help them implement their projects. Information on internships at Moscow Exchange Group is published on its careers page. The Group also actively develops special educational programs where senior managers and leading specialists of the Group’s companies give master classes for students.

In 2018, with the support of Moscow Exchange, Higher School of Economics created a basic Department of Financial Market Infrastructure at the Faculty of Economics, which brings together HSE professors and employees of Moscow Exchange. Moscow Exchange also helps the Financial University run the Securities and Financial Engineering master’s program. Sponsor support is provided to the Cybernetics Department of the Institute of Intelligent Cybernetic Systems at MEPhI National Research Nuclear University, which, in turn, implements the department’s curricula and consults students on their diploma projects and research in the interests of Moscow Exchange.

Moscow Exchange, together with the Financial University, organizes Fincontest, a specialized knowledge contest about financial markets that was first launched several years ago. Moscow Exchange helps assess the participants’ knowledge in the areas of corporate finance, securities markets, and financial analysis. It provides contestants with the chance to start their professional career.

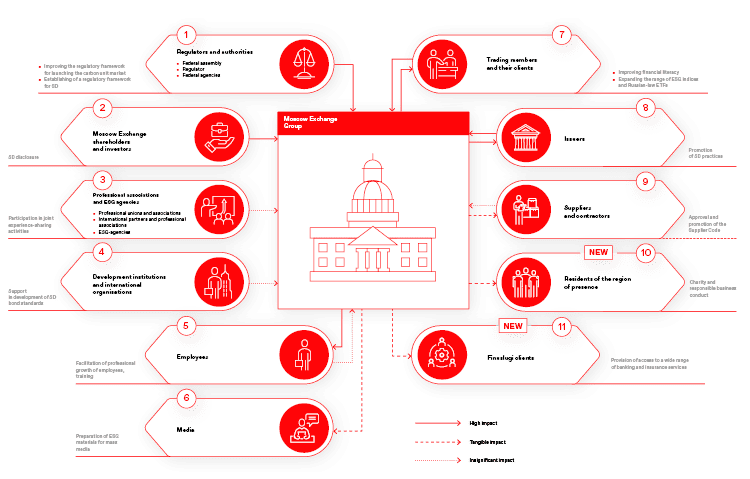

2-29

Stakeholder groups, areas, and forms of interaction

A stakeholder survey is conducted to rank material topics and prepare sustainability reports. The last stakeholder survey was conducted in 2020. In 2023, the Exchange conducted the following surveys, the results of which provided feedback on the level and themes of the Exchange’s impact on stakeholders:

- a survey of issuers’ awareness of sustainability issues and carbon units market;

- assessment of the Moscow Exchange Group Customer Satisfaction Index (CSI);

- staff engagement assessment.

Stakeholder group | Key topics for engagement | Forms of engagement |

|---|---|---|

Regulators and authorities:

| Preparing bills for financial market regulation. Preparing draft regulatory provisions governing the financial market and the development of corporate governance Control and oversight of financial markets, including the activities of the market operator, by the Central Bank of Russia | Preparation and provision of analytical materials on the development of the financial market Preparing, submitting, and supporting proposals for amendments to the Central Bank of Russia’s statutory acts regulating activities of market operators, clearing organisations, and the central counterparty. Participation in meetings of expert councils and working groups on development of the financial market. Regular reporting in accordance with the requirements for market operators |

Moscow Exchange shareholders and investors | Corporate governance, exercise of shareholders’ rights Development of the business of Moscow Exchange Group | Interaction involving the presentation of information and analytics at conferences and road shows, and through conference calls and webinars Participation by stakeholders in the exercise of their shareholder rights and in the relevant corporate governance processes |

Professional associations and ESG-agencies: National Association of Stock Exchange Participants, National Finance Association, Russian Union of Industrialists and Entrepreneurs, SSE and Russian and foreign ESG-agencies. | Cooperation on development of financial market regulation Improving financial literacy | Joint events for financial market participants, consultations on regulatory initiatives in the area of financial market development Support for activities to improve financial literacy Holding exchange forums, participating in conferences, implementing joint projects/ Development and perfection of ESG-indices methodologies. |

International organisations and development institutions: Eurasian Economic Commission, SME Corporation, VEB.RF State Corporation, Russian Direct Investment Fund, etc. | Interacting with regard to regulation and development of financial markets Developing corporate governance practices Cooperation on implementation of state development policy Attracting investments for development projects | Participating in joint activities to share experience and to discuss issues and proposals related to regulation and development of financial markets and corporate governance Issuance of bonds by development institutions Cooperating on the development of the IIM, the Growth sector, and the sustainability sector |

Employees | Working conditions, incentives, personnel management, and staff training processes; efficiency and cross-functional interaction | Creating conditions for the professional growth of employees, training |

News agencies and the media | Building transparent relations and providing relevant information in a timely manner Moscow Exchange Group news, listing rules, and market news Disclosure of information by issuers | Holding awareness-raising events Distributing press releases and newsletters |

Market participants and their clients: Brokers, Investment banks, legal entities and individuals participating in market activities | Providing information on trading at Moscow Exchange, reporting on the results of trading, products, quotes, the trading calendar, and training for market participants Discussing growth areas and new tools Participation by appropriately licensed legal entities in trading on Moscow Exchange markets. | Customer service, including KYC (Know Your Customer) procedures, information on products and services, participation in user committees, and use of Moscow Exchange software. Participation by appropriately licensed legal entities in trading on Moscow Exchange markets. Customer service, including KYC (Know Your Customer) procedures, information on products and services, participation in user committees, and use of Moscow Exchange software. Provision by Moscow Exchange of the current list of traders, quotes, the trading calendar, products, and training for private investors Conducting activities to improve financial literacy |

Issuers | Issuers raising capital on Moscow Exchange’s markets. Ensuring issuers’ compliance with listing rules | Providing direct access to the FX, Money, and Bond Markets Informing potential issuers about financing opportunities Interaction regarding disclosure by issuers Issuers’ participation in user committees Joint activities |

Suppliers and contractors | Procurement procedures Promoting competition Developing new products and services Requirements for vendors and contractors, responsible supply chains | Creating transparent conditions for participation in the procurement process Holding tenders and concluding transactions with vendors and contractors Fulfilling contractual obligations |

Residents of the region of presence | Charity and sponsorship program Financial literacy program Taxes paid | Receiving charitable and sponsorship assistance. Gaining knowledge from participating in educational and professional events, etc. the Moscow Exchange and its employees role as taxpayers. |

Finuslugi client | Access to financial services Access to products for retail clients | Providing access to a wide range of banking and insurance services. Development of special products for retail clients. |

Participation in initiatives and associations in 2023

2-28

Moscow Exchange Group Company | Name of Initiative/Association |

|---|---|

Sustainability initiatives | |

|

|

Other significant associations and initiatives | |

|

|

|

|