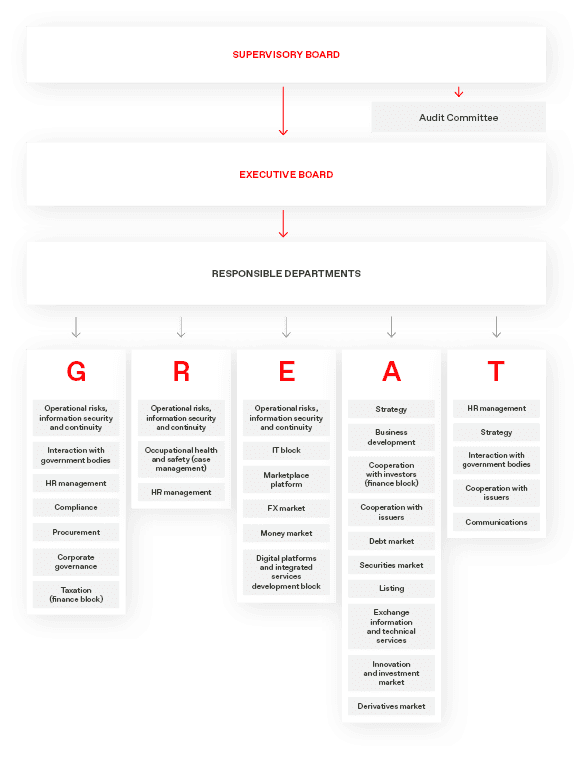

MOEX GROUP’S FOCUS AREAS: ‘GREAT’

GENUINE CORPORATE GOVERNANCE AND BUSINESS ETHICS

2-9 3-3

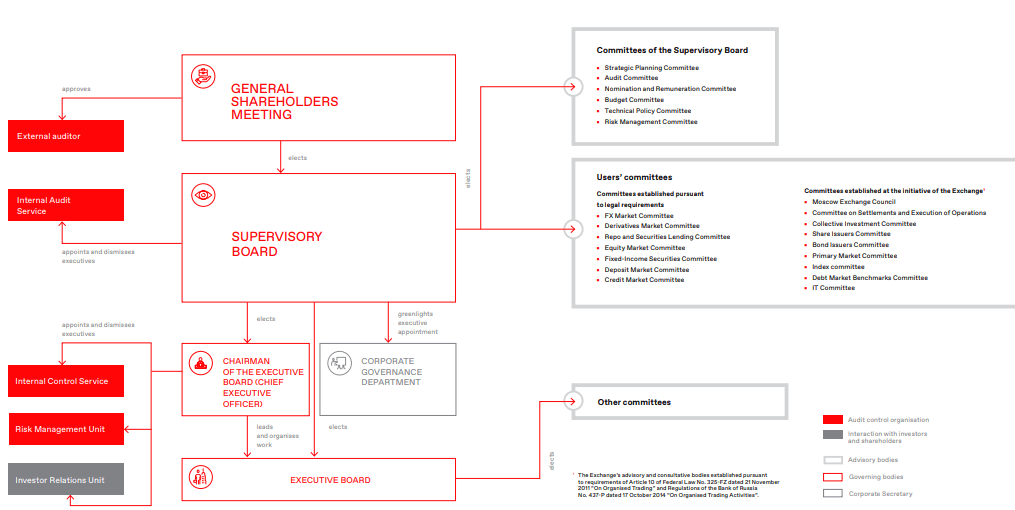

The corporate governance system

Moscow Exchange Group’s corporate governance system is based on Russian statutory rules and recommendations issued by the Central Bank of Russia, as well as on international best practices and standards. To improve the quality and effectiveness of corporate governance, the system is constantly being improved to align with the requirements of regulatory bodies, the opinions of shareholders and investors, and the Group’s development strategy.

The corporate governance system of Moscow Exchange Group is comprised of the following governing, auxiliary, and control bodies:

- the General Shareholders Meeting is the supreme governing body;

- the Supervisory Board handles general management of Moscow Exchange’s activities and strategic management;

- the Supervisory Board committees have an advisory role; their responsibilities include preliminary consideration and formulation of recommendations to help the Supervisory Board decide crucial issues;

- the chairman of the Executive Board and the Executive Board itself are the executive governing bodies; they govern day-to-day activities at Moscow Exchange;

- the Internal Control and Internal Audit services oversee the effectiveness of risk management and corporate governance practices and compliance with legal requirements, corporate policies, and business processes, and also perform other functions; an independent external auditor reviews and confirms the Group’s financial reports;

- the user committees are advisory bodies of Moscow Exchange;

- the Corporate Governance Department and the Corporate Secretary coordinate the Exchange’s actions to protect shareholders’ rights and interests.

Moscow Exchange’s Corporate Governance Code is in force at the Group; it sets out core principles and objectives of the corporate governance system, including the principles of implementing corporate governance which are to be followed by the Group’s companies. A top-level approach to management approved at Moscow Exchange and then integrated at all the Group companies. The NCC and NSD strive to implement all requirements relevant to Moscow Exchange in their activities.

Key documents:

- Federal Law No. 208-FZ dated 26 December 1995 “On Joint-Stock Companies”

- Federal Law No. 325-FZ dated 21 November 2011 “On Organized Trading”

- Central Bank of Russia Corporate Governance Code

- Listing Rules of the Moscow Exchange

- G20/OECD Corporate Governance Principles

- Internal policies, regulations and other bylaws, includingthe following:

- Charter of Moscow Exchange MICEX-RTS PJSC

- Regulation on the Identification and Prevention of Conflicts of Interest by Moscow Exchange MICEX-RTS PJSC When Acting as a Trading Organizer and Financial Platform Operator

- Succession Policy for Members of the Supervisory Board of Moscow Exchange MICEX-RTS PJSC

- Regulation on the Stock-based Long-term Incentive Program for Key Experts of Moscow Exchange MICEX-RTS PJSC

Governing bodies

General Shareholders Meeting

The General Shareholders Meeting acts in accordance with Russian legislation and the Charter of Moscow Exchange.

Supervisory Board

The Supervisory Board is the main governing body of Moscow Exchange, acting in accordance with the Charter and the Regulation on the Supervisory Board of Moscow Exchange, approved by the General Shareholders Meeting. The committees under the Supervisory Board consider sustainability-related issues in accordance with their scope of authority.

Supervisory Board members are elected by the General Shareholders Meeting to sit on the Board until the next Annual General Shareholders Meeting. The members of the Supervisory Board are elected by cumulative voting.

2-12

The competence of the Supervisory Board is defined in the Charter and is delimited from the competence of Moscow Exchange’s executive bodies, which manage its day-to-day activities.

In particular, the Supervisory Board is responsible for:

- defining the vision, mission, and strategy, of Moscow Exchange,

- the strategic management of the Exchange and its long-term sustainable development

- setting up strategic goals and key performance indicators of the Exchange.

The Supervisory Board also adopts most of internal policies.

External and internal evaluation

2-18 3-3

As per the recommendations of the Corporate Governance Code of the Central Bank of Russia and best international practices, the Supervisory Board of Moscow Exchange self-assesses the effectiveness of its activities annually. In addition, an external evaluation involving an independent consultant is carried out once every three years. In 2023,the self-assessment of the Supervisory Board was carried out..

Remuneration of the Supervisory Board members

2-19 2-20

The current system of remuneration of Supervisory Board members is set by the Policy for Remuneration and Reimbursement of Expenses (Compensations) (the “Policy”) and by the latest version of the Regulation on Remuneration and Compensation (the “Regulation”) approved in the latest version by the Annual General Meeting of Shareholders in 2023.

The Nomination and Remuneration Committee actively participates in improvement of the remuneration system for Supervisory Board members, taking into account corporate governance best practice and the experience of other public companies and international exchanges. The Policy and the Regulation apply only to members of Moscow Exchange Supervisory Board.

According to the Policy, remuneration paid to Supervisory Board members shall be sufficient to attract, retain and properly motivate individuals with the skills and qualifications necessary to work effectively on the Supervisory Board.

The Nomination and Remuneration Committee provides recommendations on remuneration of Supervisory Board members on the basis of an expert assessment of remuneration paid by Russian companies with similar capitalization and competitors of the Exchange.

The Policy and Regulation govern all types of payments, benefits, and privileges provided to Supervisory Board members and contain no other forms of short-term or long-term incentives of Supervisory Board members.

In order to implement the principle of independent decision-making, the remuneration of Supervisory Board members is not linked to the performance of the Exchange or the value of the Exchange shares and does not include stock option programs. Supervisory Board members enjoy no pension contributions, insurance programs (apart from the Supervisory Board member liability insurance and the conventional insurance associated with travelling to perform duties as a director or to participate in Supervisory Board activities), investment programs, or other benefits or privileges, unless specified in the Policy and Regulation.

The Exchange does not provide loans to Supervisory Board members and does not enter into civil law contracts with them for the provision of services to the Exchange, including on non-market terms.

Remuneration for performing the Supervisory Board member duties shall not be paid to government officials, employees of the Bank of Russia, employees and managers of the Exchange or its subsidiaries.

Remuneration of directors for performing the duties of Supervisory Board members comprises basic and supplementary components.

The level of basic remuneration of a member of the Supervisory Board depends on whether such member is independent or not, and:

- for an independent member of the Supervisory Board, amounts to RUB 9 mln;

- for a non-independent member of the Supervisory Board, amounts to RUB 6.5 mln.

The following differentiated supplementary remuneration is paid to Supervisory Board members for performance of additional duties, requiring extra time and effort, of Chairman of the Supervisory Board, Deputy Chairman of the Supervisory Board, Chairman of a Supervisory Board Committee, or member of a Supervisory Board Committee:

- for the Chairman of the Supervisory Board, RUB 11 mln;

- for the Deputy Chairman of the Supervisory Board, RUB 4 mln;

- for the Chairman of a Supervisory Board Committee, RUB 3.75 mln;

- for a member of a Supervisory Board Committee, RUB 1.5 mln.

In order to ensure remuneration of Supervisory Board members corresponds to changing market demands, until the next cycle of remuneration level review, the Regulation provides for adjustment of the level of remuneration of Supervisory Board members in line with the consumer price index at the end of the year in which the corresponding composition of the Supervisory Board was elected, and accrued starting from 1 January 2022.

The basic and additional remuneration of a Supervisory Board member may be reduced by 50% if the Supervisory Board member has attended less than 75% of the meetings of the Supervisory Board or committees in person, respectively. If a member of the Supervisory Board took part in 1/3 or less of the total number of meetings of the Supervisory Board or its committees or in ¼ or less of in-person meetings of the Supervisory Board or its committees, the respective part of remuneration is not paid.

Apart from the remuneration for work on the Supervisory Board and Supervisory Board Committees, members of the Supervisory Board are reimbursed for travel expenses relating to participation in in-person meetings of the Supervisory Board or its Committees, General Meetings of Shareholders, as well as events attended while performing duties of Supervisory Board members.

As per the current legislation of the Russian Federation, the “say on pay” concept is not applicable.

Executive Board

The Executive Board manages the day-to-day operations of Moscow Exchange. The chairman of the Executive Board acts on behalf of Moscow Exchange without the need for a power of attorney. He or she represents its interests, issues orders, gives instructions mandatory for all Moscow Exchange employees, and delegates certain powers.

Remuneration of Moscow Exchange executives

2-19 2-20

The system of remuneration of Moscow Exchange executives is regulated by the Policy on Remuneration and Compensation of Expenses of Executive Body Members. The policy sets out the principles of and approaches to remuneration; it establishes the procedure for determining the amount of remuneration and the types of payments, benefits, and perks granted to executive body members. Remuneration consists of a fixed and a variable component. The variable component accounts for a significant share of annual pay. There are plans to review and implement sustainability KPIs for Executive Board members. Consultants are not involved in determining remuneration.

The total amount of remuneration to be paid to Executive Board members is assessed by the Nomination and Remuneration Committee for compliance with the remuneration level at comparable companies, based on research purchased from leading consulting companies. Members of Moscow Exchange’s executive bodies are not paid remuneration for their work on the governing bodies of other companies of the Group.

Preventing conflicts of interest

2-15

FN-EX-510a.2

In order to prevent conflicts of interest among members of the governing bodies, the Policy on Management of Conflicts of Interest and Corporate Disputes has been adopted. The key principles of this policy include

- the requirement that members of the Supervisory Board, members of the Executive Board, and the chairman of the Executive Board notify Moscow Exchange of conflicts of interest;

- priority of the interests of Moscow Exchange and its shareholders over the personal interests of the members of Moscow Exchange’s governing bodies;

- contribution of the Supervisory Board to the prevention, identification, and settlement of corporate conflicts;

- priority participation of independent directors in preventing corporate disputes and performance of significant corporate actions by Moscow Exchange.

Sustainability management system

2-12 2-13 2-14

Sustainability-related powers are distributed among the Supervisory Board, the Executive Board and the chairman of the Executive Board; this distribution is established in the Charter of Moscow Exchange MICEX-RTS PJSC.

In accordance in the Charter the Executive Board adopts sustainability reports.

The Executive Board shapes Moscow Exchange’s overall sustainability agenda and is responsible for operational decisions in this area. In 2021, the Executive Board decided to form the Sustainability Goals Working Group (SGWG). The body was created under the sustainability roadmap; its functions include the development of goals on economic, environmental, and social aspects. In 2023, the body convened once and considered the issues of the Report on the implementation of the roadmap for 2022 and the approval of the Roadmap for Sustainable Development for 2023. The chairman of the Executive Board manages sustainability-related activities and may delegate their management to operational subdivisions.

The Chairman of the Executive Board reports to the Supervisory Board on a quarterly basis on the status and performance of tasks in the following sustainability areas:

- Information security;

- Sustainable technological development;

- Risk management;

- Business ethics and compliance;

- Market access and customer relations;

- Development of sustainable exchange financing;

- The Growth Sector and the Innovation and Investment Market Sector;

- Employee engagement and performance;

- Informing issuers about the sustainability trends, standards and practices;

- Financial literacy improvement initiatives.

Management of the sustainability agenda at the level of operational subdivisions is shown in the diagram.

The chairman of the Supervisory Board and independent directors are regularly invited to speak at roundtables and conferences where sustainability-related issues are discussed. There is also interaction on relevant issues at the level of government authorities. The chairman of the Supervisory Board may receive enquiries and requests from stakeholders through the feedback form available on the corporate website. There are also informal channels for interacting with stakeholders. The members of the Supervisory Board are open to dialogue with all stakeholders, including through informal channels of communication, to receive and process enquiries and requests and submit them to management.

Business ethics and anti-corruption

Maintaining and developing a culture of trust and responsibility is a key priority of Moscow Exchange Group’s updated strategy. The Group upholds high standards of corporate business conduct and values its reputation. In particular, Moscow Exchange adheres to the following principles

- zero tolerance to corruption principle (aversion to corruption in all forms and manifestations);

- employee engagement principle;

- principle of proportionality of anti-corruption procedures to the corruption risk;

- periodic risk assessment principle;

- mandatory counterparty inspection principle;

- openness principle;

- procedure efficiency monitoring and implementation control principle;

- principle of accountability and inevitability of punishment;

- conflict of interest prevention principle.

Key documents:

- Policy on Preventing Corruption-Related Offenses

- Code of Professional Ethics of Moscow Exchange

- Code of Ethics of NSD NCO JSC

- Code of Business Ethics of NCC NCO JSC

- Policy on Preventing Corruption-Related Offenses at NCC NCO JSC

- Procedure for Preventing Conflicts of Interest at NCC NCO JSC

- Moscow Exchange Information Policy

- NCC NCO JSC Information Policy

- Rules of Internal Control of NCC NCO JSC to Combat the Legalization (Laundering) of the Proceeds of Crime, the Financing of Terrorism, and the Financing of the Proliferation of Weapons of Mass Destruction

- Regulation on the Contractual Activities of NCC NCO JSC

- Information on efforts by Moscow Exchange Group counterparties to prevent money laundering and financing of terrorism

- Moscow Exchange’s Know Your Customer/Counterparty Policy

- Conflict of Interest and Corporate Conflict Management Policy

- Regulation the Regulations on Managing the Risks of a Financial Platform Operator of the Moscow Exchange

- Each structural unit of Moscow Exchange is responsible for identifying and assessing risks in its own processes, including corruption-related risks

- Internal Control and Compliance Department

- Audit Committee of the Supervisory Board

2-23

Key principles of the Moscow Exchange Code of Ethics:

- respect for staff and equal opportunity;

- respect for staff civil rights, including their right to freedom of speech;

- zero tolerance of corruption;

- prevention of conflicts of interest;

- combating money laundering and terrorism financing;

- countering the use of inside information;

- protection of Moscow Exchange’s assets, including intellectual property rights;

- protection of shareholders’ interests;

- non-disclosure of confidential information and protection of intellectual property rights;

- maintaining trust-based relationships with customers, partners, and government authorities;

- neutral stance towards political and religious activities (the Group’s employees are, however, welcome to engage in such activities at their own expense and as private individuals);

- corporate social responsibility and commitment to sustainability.

Anti-corruption

The Group’s companies adhere to the principle of aversion to corruption in all forms and manifestations. The Group’s anti-corruption management approaches are defined in top-level documents, local regulations, and are also specifically implemented in key company regulations (e.g. procurement regulations).

Key principles of the anti-corruption policy:

- Moscow Exchange prohibits the offering/acceptance of any items of value (including gifts and incentive payments) in soliciting assistance to solve any issues.

- Moscow Exchange prohibits transactions with third parties that would act on behalf of or in the interests of Moscow Exchange.

- Moscow Exchange has corruption risk controls embedded in all aspects of its activities.

- Moscow Exchange incorporates anti-corruption provisions (clauses) into contracts and vets all counterparties.

- Moscow Exchange provides mechanisms for its staff and third parties to report information on corruption risks (including anonymously).

Key documents:

- Code of Professional Ethics of Moscow Exchange;

- Regulation on the Identification and Prevention of Conflict of Interest in the Implementation of the Activities of the Organiser of Trading and the Activities of the Operator of the Financial Platform by Moscow Exchange (approved by the decision of the Supervisory Board of the MOEX dated 22 December 2021);

- The policy aimed at preventing corruption offences;

- The Rules for Reporting Violations and Abuses.

Countering Unfair Practices Control

Measures to prevent, detect and combat misuse of insider information and/or market manipulation have been developed and are in place at Exchange, including with regard to the availability of internal documents, designation of responsible persons and enforcement of internal control rules to prevent, detect and combat misuse of insider information and/or market manipulation.

Financial monitoring

In order to combat money laundering, financing of terrorism and proliferation of weapons of mass destruction, the internal control system to combat money laundering, financing of terrorism and proliferation of weapons of mass destruction has been developed at Exchange.

Moscow Exchange was registered with the US Internal Revenue Service (IRS) as a financial institute observing the requirements of FATCA (Participating Financial Institution not covered by an IGA). Exchange was assigned with the Global Intermediary Identification Number (GIIN): XNBBND.00005.ME.643.

CRS (Common Reporting Standard) is an international equivalent of FATCA aimed at improving the tax transparency and preventing global evasion of taxes. In May 2016, the Russian Federation confirmed its participation in fulfilling the CRS requirements. The Russian financial market organisations are obliged to identify customers who are tax residents of foreign countries (territories) and provide data on such customers and their accounts to the Federal Tax Service of Russia.

Compliance for the market

Moscow Exchange creates compliance technologies helping the market participants consider their customers and financial instruments through the lens of Exchange experience, improve the quality of compliance with the regulatory requirements and risk assessment.

Since 1 July 2019 requests for the list of insiders to be provided by bidders have been sent by Exchange via the electronic data interchange system (EDI) to the address of the bidder in the Exchange EDI. The developed Lists of Insiders system has been intended at creating, maintaining, accounting, storage and transfer of the lists of insiders to the trade organiser in accordance with Art. 9 of the Federal Law No. 224-FZ dated 27 July 2010 On Countering the Misuse of Insider Information and Market Manipulation and Amending Certain Laws of the Russian Federation (hereinafter referred to as the Insider Law).

The Lists of Insiders system has been designed to provide functionality for the submission of lists of insiders to stock exchanges by entities subject to the Insider Law.

Exchange guarantees secure transmission of information over a closed communication channel, using SSL connection and data encryption.

In addition, Exchange mitigates the risks of unauthorised access to information contained in the Lists of Insiders system ensuring that authorised persons of entities subject to the Insider Law are authorised when they are provided with a login and password to access the System.

Code of Conduct

Exchange promotes the establishment and distribution of the best compliance practices in the market. In 2021, in order to establish and maintain standards of good conduct, the adherence to which contributes primarily to a favourable investment environment in the Russian financial market, a Code of Conduct was created as the joint initiative of the Bank of Russia, SRO, Moscow Exchange Group, as well as trading and clearing members, a mechanism for adherence to the Code was implemented, and information on the Code was collected and reviewed. The Code was approved by the Exchange Council and the Supervisory Board of Moscow Exchange.

The Code is advisory in nature. At that, taking into consideration the importance of the Code’s goals, Moscow Exchange Group encourages organisations to join the Code and strive to conduct their activities in the financial market in accordance with the Code principles. In order to join the Code, a signed Declaration of Joining the Code shall be sent to the Department of Internal Control and Compliance of Moscow Exchange.

If a breach of the Code or a situation requiring attention related to the Code or its scope of application is identified, the relevant information can be forwarded to Hot Line for Compliance. If necessary, the Bank of Russia, SRO, organisations (a working group format) will be invited to consider the respective inquiries.

Key documents:

- The Federal Law No. 224-FZ dated 27 July 2010 On Countering the Misuse of Insider Information and Market Manipulation and Amending Certain Laws of the Russian Federation;

- Instructions of the Bank of Russia dated 22 April 2019 No. 5129-U On the Procedure for Transfer by Legal Entities specified in Cl. 1,

3–7, 11 and 12 Art. 4 of the Federal Law No. 224-FZ dated 27 July 2010 On Countering the Misuse of Insider Information and Market Manipulation and Amending Certain Laws of the Russian Federation, of the List of Insiders to the Trade Organiser, through which Transactions in Financial Instruments, Foreign Currency and/or Goods are Carried Out, upon its Request; - Procedure for the Transfer of Insider Lists to Moscow Exchange MICEX-RTS Public Joint-Stock Company dated 22 July 2022;

- Code of Conduct.

- Department of Internal Control and Compliance.

Mechanisms for reporting instances of corruption and violations of standard business practices

205-2 2-23 2-25 2-26 3-3

The Group created SpeakUp!, a portal for reporting compliance-related issues, enabling the responsible officers to be promptly informed of possible instances of corruption and violations of standard business practices. The information reported is considered confidentially; the Group’s anti-corruption policy guarantees non-retaliation – official or

Employees can also use the SpeakUp! portal to get advice on ethical business conduct and anti-corruption. Moscow Exchange adheres to the open-door principle; employees can also directly contact the compliance department by phone, submit questions via a dedicated email address, and use the internal compliance portal. Information about obtaining advice on business ethics is provided to employees in the course of training on anti-corruption policies and methods.

The following procedure to identify situations with signs of a breach has been implemented and used at the Exchange:

- conducting a mandatory investigation;

- if necessary, the responsible department (compliance) may involve other departments in the investigation;

- when carrying out an inspection, written explanations may be obtained from those who have committed violations, as well as other documents necessary for the purposes of the inspection;

- a report is drawn up on the inspection results including the grounds for and timing of the inspection, the violations found during the inspection, their causes and the persons responsible for them, as well as proposals and recommendations for remedying the violations found and preventing them in the future, which is submitted to the Chairman of the Executive Board of Moscow Exchange;

- based on the inspection results the Chairman of the Executive Board of Moscow Exchange decides on the imposition of disciplinary and/or material liability actions to persons who have committed violations, as well as on sending documents to law enforcement bodies and/or the court for the imposition of property, administrative, criminal liability actions in accordance with the law of the Russian Federation.

To ensure that staff awareness of anti-corruption practices and methods remains high, Moscow Exchange Group provides information to its personnel at several levels:

- Upon hiring, new employees undergo a brief training course and read and sign key documents.

- Whenever the values, principles, or behavioral standards and rules of Moscow Exchange change, staff are informed accordingly through the internal portal and other means of internal communication (the corporate magazine, posters, newsletters, etc.).

- Supervisory Board members who are not employees of Moscow Exchange Group are introduced to new values, principles, standards, and rules of conduct when approving the relevant documents.

- The Group also runs an internal training course that is mandatory for all employees.

Approach to identifying material breach of legislation

2-27 3-3

Pursuant to the Rules for Managing Risks Associated with Activities of a Trade Organiser and Digital Financial Asset Exchange Operator of Moscow Exchange, the events, which led to the following consequences, shall be treated as a material breach of legal requirements of the Russian Federation:

- penalties imposed by the supervisory bodies in the form of fines exceeding RUB 700,000;

- possible suspension of certain operations, suspension of activities;

- a surge of negative feedback from customers/counterparties in excess of 70 % of the average number of negative publications for the previous year;

- negative information in the media about the Exchange management;

- a financial loss exceeding the limit set for the current year for the relevant type of risk;

- Disruption of key Exchange systems;

- violated deadlines for the implementation of key strategic areas for 12 months or more;

- a significant increase in the implementation cost of key strategic areas;

- a significant reduction in the profitability of the strategic areas being implemented;

- a significant reduction in the profitability of the key Exchange products;

- significant information leaks, successful attacks on key Exchange systems;

- other consequences able to provide a significant negative impact on Exchange operations.

Approach to taxation

207-1

The approach to taxation is described in the tax strategy of Moscow Exchange Group. In 2023, a tax risk management (control) system was introduced in most of the Group’s companies, including Moscow Exchange, NSD and NCC. In its tax-related activities, the Group relies on the requirements of the tax legislation and considers effective management of tax risks to be a significant factor in increasing the Group’s value. In 2023, there were no tax disputes at the Group.

The Company values its reputation as a responsible taxpayer and strictly complies with tax laws in all jurisdictions where it does business. As a major taxpayer, the Group recognizes the importance of being a socially responsible business and strives to balance corporate, government, and public interests.

The tax strategy was approved in 2022 and is posted on the website of PJSC Moscow Exchange.

The Group adheres to the following guiding principles for the tax function:

- systemic, consistent, and transparent management of tax-related issues;

- clear allocation of functions and responsibilities among the parties involved in tax relations;

- participation of the Group’s senior management in decision-making on key tax issues, as well as timely involvement of tax experts in decision-making on corporate issues;

- availability of effective tools for monitoring the implementation of decisions, including automation of key processes and procedures.

The tax strategy is approved by the Supervisory Board of Moscow Exchange. The tax strategy is revised whenever the approaches set out in the tax strategy are changed.

207-2

The Internal Audit Service (IAS) is responsible for monitoring compliance with the tax strategy and legal requirements. Identification, description and assessment of tax risks, including tax monitoring, are carried out by the Taxation Group. At the same time, the tax management system is assessed by the IAS at least once a year. The approach to taxation is set out in the Group’s tax strategy.

Moscow Exchange and the NCC take the following approach to tax risks:

- tax risks are integral to the Group’s risk management and internal control system; they are identified according to the principles established by Moscow Exchange’s Supervisory Board: continuity, economic feasibility, and efficiency;

- all identified tax risks are subject to an assessment and materiality ranking;

- tax risks are monitored quarterly through control procedures.

The fulfilment of tax obligations is subject to an annual audit procedure and is disclosed in the Group’s annual reports.

207-3

Moscow Exchange and the NCC are involved in tax monitoring. The NSD plans to join tax monitoring in 2025. Tax monitoring refers to an open dialogue between the Group companies and the tax authorities. The exchange of information is facilitated via remote access to the information systems of Moscow Exchange and the NCC, as well as to their accounting and tax reports. This method of providing data to the tax authority allows the Group to promptly coordinate a position with the tax authority on the taxation of planned and completed transactions.

Moscow Exchange has joined the following organisations which discuss issues related to transparent taxation: Non-profit organisation National Financial Association (NGO NFA), Association of Banks of Russia (ABR), and National Association of Stock Market Participants (NAUFOR). Moscow Exchange I involved in preparing amendments to tax legislation based on best practices, representing the interests of financial market participants.

The Group discusses pressing issues associated with amendment of the tax legislation at working groups, committees, and roundtables; it also prepares draft regulations and requests for clarification of the legislation. It can also analyze, update, and submit proposals to government authorities to amend the tax legislation.

Key documents:

- Tax Strategy of Moscow Exchange Group

- operational subdivisions: Finance Unit (Accounting, Taxation Group);

- Executive Board of Moscow Exchange (review of risk management regulations);

- Risk Management Committee;

- Supervisory Board (taking decisions on the tax risk management policy).

Supply chain management

Moscow Exchange Group emphasizes responsible supply chain management and close cooperation with suppliers of products and services in order to ensure economically efficient of procurement and to mitigate relevant financial and non-financial risks. The Group has a vested interest in developing fair competition on the market and strives to cooperate with reliable and responsible suppliers. To this end, in 2024, a function of independent financial control of all key stages of procurement will be created, and special emphasis will be applied on the principle of multi-vendor as the basis for competition and savings in procurement process, the abandonment of procurement by e-mail in favor of ETP (electronic trading platforms), and overbidding and anti-dumping measures will also be introduced.

Key documents:

- Regulation on Procurement of Moscow Exchange (subject to changes that came into force from 01/01/2024);

- Internal regulations on interaction between Moscow Exchange and other companies of the Group

- operational subdivisions (procurement initiation, preparation of requirements and terms of reference)

- Procurement Assurance Department (organisation and implementation of procurement)

- Procurement Committee (approval of purchases exceeding RUB 8 million)

- Executive Board of Moscow Exchange (approval of purchases exceeding RUB 300 million)

- Supervisory Board of Moscow Exchange (approval of purchases exceeding RUB 1 billion)

Key principles of procurement

- transparent procurement: any supplier may take part in the Moscow Exchange’s procurement; auctions are held on a B2B, Roseltorg and Bidzar digital trading platforms;

- equality, fairness, non-discrimination, and no unreasonable competition restrictions imposed on participants in procurement: all participants, regardless of the size of their business and their country of registration, enjoy equal rights to participate if the transparency and substantive criteria are met;

- no provision of services by suppliers who violate Russian legislation currently in effect, including the Labor Code;

- zero tolerance for any corrupt practices.

2-6

The bulk of procurement by Moscow Exchange Group relates to IT, specifically the development, maintenance, and purchase of modern software and hardware. Due to the specific requirements of Moscow Exchange, its activities often demand unique technological solutions. In most cases, such challenges are solved by consultants and contractors. The Group contributes to boosting demand for innovative and high-tech products and services, as well as creating new jobs in the supply chain.

Supply chain risk management

414-1

Moscow Exchange Group always assesses economic, financial, and related-party risks associated with all its suppliers, using the latest data for verification (which should be no older than one year). Suppliers assessed to have a high level of risk are not granted contracts. If a supplier is found to be dishonest (breaching a contract or bidding requirements), they may be disqualified.

In accordance with internal regulations, the procurement documentation includes a link to the corporate portal or an email address where losing bidders can submit feedback on the transparency and fairness of procurement procedures.

To manage ESG risks in the supply chain, Moscow Exchange Group uses standard contract templates containing clauses stipulating that suppliers must comply with Russian legislation (including the Labor Code), as well as a clause emphasizing the Group’s zero tolerance for corruption and bribery. In the agreements concluded between Moscow Exchange Group and its suppliers, the parties warrant that their employees will not offer, solicit, or consent to any corrupt payments (in cash or valuable gifts) to any persons, nor accept such money or gifts.