MOEX GROUP’S FOCUS AREAS

GENUINE CORPORATE GOVERNANCE AND BUSINESS ETHICS

Moscow Exchange Group adheres to best practices and standards in corporate governance, ethics, and business conduct. The Group is also developing a system for internal control and risk management. Sustainability principles are reflected in the activities of the Group’s corporate governance bodies. The scope of issues considered at Supervisory Board meetings is expanding. Moscow Exchange continues to develop policies to regulate the management of sustainability-related issues, implementing best practices in business conduct among the Group’s companies, in the supply chain, and also among issuing companies and other financial market participants.

Moscow Exchange Group’s objectives and the UN Sustainable Development Goals:

- SDG 5.5 Ensure gender balance at the Company

- SDG 5.5 Promote gender equality in the business environment

- SDG 12.6, 13.3 Raise companies’ awareness of sustainability-related trends, standards, and practices

- SDG 4.7 Ensure the Group’s personnel have the competencies they need to manage sustainability issues effectively

Shareholder | Voting power (units) | Voting power (%) |

|---|---|---|

Central Bank of the Russian Federation | 268,151,437 | 11.780 |

Sberbank of Russia | 227,682,160 | 10.002 |

VEB.RF | 191,299,389 | 8.404 |

EBRD | 120,472,902 | 5.292 |

State Street Bank & Trust Company | 121,692,450 | 5.346 |

MICEX-Finance | 15,716,469 | 0.690 |

Free float (excl. MICEX-Finance; incl. State Street Bank & Trust Company) | 1,453,079,101 | 63.832 |

This subsection describes the Moscow Exchange Group efforts in developing the compliance system, projects aimed at combating corruption and increasing adherence to ethical principles of business conduct, as well as at further improving the quality of corporate governance in the companies of the Group. Figures for 2021, 2022 and 2023 are available in the “Genuine corporate governance and business ethics” subsection of the “Key Sustainability Data” section. See the “Genuine corporate governance and business ethics” subsection of the “Sustainability Approaches and Procedures” section for information on key policies, procedures, and responsible departments.

Corporate governance

2-9

The corporate governance structure of Moscow Exchange consists of the General Shareholders Meeting, the Supervisory Board, the Executive Board, and Chairman of the Executive Board, who is the sole executive body.

General Shareholders Meeting

Moscow Exchange’s share capital structure is notable for:

- the absence of a controlling shareholder or shareholders with a stake exceeding 12%;

- high share of free float (63,832 %).

Moscow Exchange strives to balance its shareholders’ interests; it performs its infrastructural function on the financial market effectively.

According to the Charter of Moscow Exchange, each share entitles the holder to one vote at the General Shareholders Meeting. See the official website for more details on the decisions made at general shareholders meetings.

Supervisory Board

In order to comply with the corporate governance requirements established by the Listing Rules, as well as to ensure the fullest compliance with the Corporate Governance Code of the Central Bank of the Russian Federation, the following measures were taken in 2023

2-9 2-10 2-11 2-17

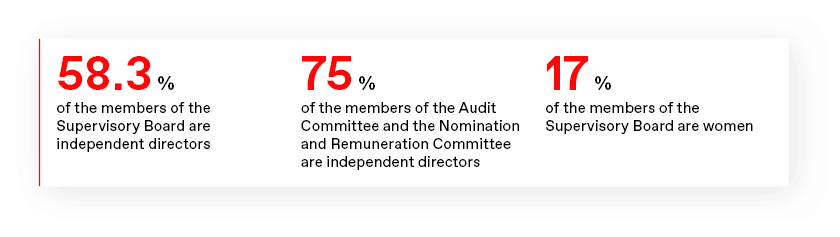

- 12 non-executive directors were elected to the 12-member Supervisory Board of which 7 are independent directors;

- all independent directors meet the independence criteria set by the Listing Rules;

- the Audit Committee and the Nomination and Remuneration Committee consist of independent members of the Supervisory;

- a non-executive director was appointed as Chairman of the Supervisory Board;

- in accordance with clause 12.2 of the Charter of Moscow Exchange, the members of the Supervisory Board are elected by the General Meeting of Shareholders for a term until the next Annual General Meeting of Shareholders and may be re-elected an unlimited number of times;

- the proportion of women on the Supervisory Board is 17%;

- the principle of forming the Supervisory Board and the Executive Board is based on the professional competences of the members of the Supervisory Board or the Executive Board, respectively;

- the Exchange seeks to ensure that different age groups are represented on the governing bodies; to date, these include those aged 40+, 50+, 60+ and 70+;

- The Supervisory Board brings together professionals with diverse profiles (entrepreneurial, functional, country-specific) and international competencies (in the area of the exchange industry, digital products and finance), which enables the Supervisory Board to address issues comprehensively and engage in meaningful discussions from different perspectives. Two members of the Supervisory Board hold positions in higher education institutions and are representatives of the academic and student communities.

The Supervisory Board includes representatives of the following stakeholders of the Moscow Exchange Group:

- Regulators

- Shareholders and Investors of Moscow Exchange

- Market participants and their clients

- Issuers

Member of the Supervisory Board | Total length of service (years) | Number of other positions (other than with Moscow Exchange) |

|---|---|---|

Director 1 | 15 | 2 |

Director 2 | 10 | 3 |

Director 3 | 6 | 8 |

Director 4 | 15 | 1 |

Director 5 | 2 | 1 |

Director 6 | 2 | 1 |

Director 7 | 2 | 0 |

Director 8 | 5 | 0 |

Director 9 | 1 | 0 |

Director 10 | 2 | 3 |

Director 11 | 2 | 3 |

Director 12 | 2 | 0 |

In 2023, two strategy sessions were held to dive into the specifics of the Moscow Exchange Group’s business, discussing various aspects of Moscow Exchange’s business development, including areas such as technology development, the Sustainability Sector, the carbon unit market and risk management.

Further work on these issues is planned in the Group companies.

2-16

The Supervisory Board keeps abreast of critical issues through a specialized system for supporting the governing bodies’ activities. Once information on critical issues is received, all Supervisory Board members are sent a special notification. In the reporting year there were no critical issues that would require the involvement of members of the Supervisory Board.

In 2023, the following committees operated under the Supervisory Board, carrying out preliminary consideration of issues and preparing decision-making recommendations:

- Strategic Planning Committee;

- Audit Committee;

- Nomination and Remuneration Committee;

- Risk Management Committee;

- Technical Policy Committee.

2-9 2-12 2-13 2-15

Committee | Key tasks | Number of meetings |

|---|---|---|

Strategic Planning Committee | Improving the efficiency of Moscow Exchange and its subsidiaries through preliminary consideration and preparation of suggestions for the Supervisory Board on the preparation, development, and implementation of long- and medium-term strategic plans and objectives for Moscow Exchange | 12 |

Audit Committee | Ensuring the effective work of the Moscow Exchange Supervisory Board in resolving issues related to control over financial and economic activities (including audit independence), verifying the absence of conflicts of interest, and evaluating the findings of audits of Moscow Exchange’s financial statements | 11 |

Nomination and Remuneration Committee | Ensuring the effective work of the Supervisory Board in resolving issues related to the activities of Moscow Exchange and of companies under the direct or indirect control of Moscow Exchange with regard to nomination and remuneration of the members of supervisory boards and governing bodies, as well as of other key executives and members of audit committees | 14 |

Risk Management Committee | Participating in the improvement of the risk management system of Moscow Exchange and the Group in order to improve the reliability and efficiency of Moscow Exchange’s operations | 7 |

Technical Policy Committee | Developing and improving the efficiency of Moscow Exchange and the Group by preparing recommendations and expert opinions covering technical policy and the development of IT and software for the Supervisory Board, the boards of directors (supervisory boards) of the Group’s companies and their committees, and for the governing bodies of Moscow Exchange and the Group’s companies | 8 |

2-24

The Supervisory Board approves risk appetite and risk management policies (including by topic), reviews reports on the risk management system, and decides on corrective measures based on those reports.

The Supervisory Board has a Risk Management Committee that also involves other companies of the Group in its activities.

2-19 2-20

Each Supervisory Board member is paid a fixed amount, depending on

- the Supervisory Board member’s status (compliance with the independence criteria);

- additional functions performed (as chairman or deputy chairman of the Supervisory Board);

- contribution to the work of the committees under the Supervisory Board (as committee chairman or member);

- attendance at meetings of the Supervisory Board.

Indicator | Amount (RUB thousand) |

|---|---|

Remuneration for work in the governing body | 140,084.55 |

Salary/wage | 0.00 |

Bonus | 0.00 |

Commission fees | 0.00 |

Expense reimbursement | 0.00 |

Other types of remuneration | 3,251.60 |

Total | 143,336.15 |

Evaluation of the effectiveness of the Supervisory Board and its committees

2-18

Prerequisites and grounds for the evaluation

In accordance with the recommendations of the Corporate Governance Code and international best practices, Moscow Exchange annually evaluates the effectiveness of the Supervisory Board. Pursuant to internal regulations, the Nomination and Remuneration Committee of the Supervisory Board engages external consultants regularly (once every three years) to conduct an independent evaluation. In other periods, the Supervisory Board undergoes the self-assessment procedure. In 2023, a self-assessment of the Supervisory Board was carried out.

Evaluation objectives and purposes

The objectives of the evaluation are to monitor the dynamics of changes in the work of the Supervisory Board and the commissions and to identify areas for improving the effectiveness of the Supervisory Board and its individual members. In addition, a particular focus of the 2023 evaluation was made towards the renewed practices of the Supervisory Board in order to adapt to doing business in the context of geopolitical changes.

The self-assessment process involves the directors answering questions focusing on analysing the Supervisory Board’s effectiveness on the following key components:

- Formation and membership of the Supervisory Board;

- Organisation of Supervisory Board meetings;

- Proper attention given by the Supervisory Board to relevant and essential matters;

- Level of directors’ involvement and preparation

- Director development;

- Leadership and strategic goal setting;

- Succession planning, remuneration and working with management;

- Risk management;

- Role of the Chairman and independent directors.

Directors’ understanding and adherence to compliance requirements.In the interim between the self-assessment in spring 2023 and the analysis of self-assessment data in autumn 2023, strategic sessions were convened, working groups comprised of directors and management were established, and Supervisory Board training was scheduled, thus allowing a prompt response to individual comments made in the course of the self-assessment.

Evaluation methodology

The self-assessment process takes the form of an electronic questionnaire filled in anonymously by the members of the Supervisory Board. The questionnaire form has 100 questions, including some recurring questions worded differently so as to obtain maximum possible accuracy of the information from the assessment. Assessment was well representative, with 7 out of 12 directors participating, but was second to previous assessments, with 10 out of 12 directors participating. However, the overall average score remains at a high level (6.1 out of 7 points, the same as in 2022).

Evaluation results

According to the 2023 self-assessment, the Supervisory Board has demonstrated marked improvement in its effectiveness in some aspects that were highlighted for improvement during the previous external assessment in 2022. Namely, such aspects included Moscow Exchange Group corporate governance vision, priority of in-person meetings over on-line ones, better-quality strategic discussions at the meetings and better balance of the advisory and controlling functions of the Supervisory Board. A particularly positive outcome from the completed self-assessment is that no consolidation of the Supervisory Board members’ opinions was seen towards any critical area, which was characteristic of previous assessments and self-assessments.

The strengths of the Supervisory Board stay the following aspects:

- Effective dialogue between the Supervisory Board and management: clear separation of powers, minimal interference by the Supervisory Board in operational management, increased trust, increased management autonomy, mutual support and a high speed of interaction;

- Professional and diverse composition: The Supervisory Board brings together professionals with diverse profiles (entrepreneurial, functional) and competencies, which enables the Supervisory Board to address issues comprehensively and engage in meaningful discussions from different perspectives. The Supervisory Board continues to demonstrate gender and age diversity;

- Leadership style of the Chairman of the Supervisory Board: the Chairman is deeply involved in the work of the Supervisory Board, supports directors and management, effectively manages relations with key stakeholders, and represents the company externally;

- Corporate Secretary and support for the Corporate Governance Department: the Corporate Secretary promptly implements best corporate governance practices and ensures the effective operation and support of the Supervisory Board.

Remuneration of executives at Moscow Exchange in 2023

2-19 2-20

- a guaranteed component (salary);

- a variable component, including a short-term element (annual bonus) and a long-term element (remuneration under the Long-Term Incentive Program Based on Shares);

- Benefits and privileges;

- Other payments and compensations provided for by law.

The structure of remuneration elements and their ratio is established individually as a percentage of the total target annual income and differentiated depending on the degree of influence of a member of the executive body on the financial performance of the Company.

The structure of remuneration elements and their ratio is established individually as a percentage of the total target annual income and differentiated depending on the degree of influence of a member of the executive body on the financial performance of the Company.

Type of payment | Amount of payment |

|---|---|

Remuneration payable separately for participation in the governing body’s activities | 0.00 |

Salary | 172,041.71 |

Bonuses | 360,538.86 |

Commission fees | 0.00 |

Compensation of expenses | 361,348.76 |

Other types of remuneration | 1,068.64 |

Total | 533,649.22 |

2-21

Due to existing market practices, it was decided not to disclose information about the remuneration of the most highest-paid official of Moscow Exchange Group and the ratio of his remuneration to the median remuneration of the Group’s employees.

Compliance system

Compliance is a crucial aspect of good corporate governance. The Group has built a compliance management system with developed business processes, procedures, corporate policies, and local regulations; risk assessments are carried out regularly (at least once a year) in all compliance areas.

Developing a corporate compliance culture, developing a unified approach to compliance risk management, as well as quality support for business processes in the face of a significant number of new regulatory requirements became one of the main areas of focus for corporate governance in 2023.

In 2023, ISO 37301:2021 certification was passed for the first time at the Moscow Exchange Group level. In particular, the Moscow Exchange and NCC confirmed compliance with the standard, while NSD passed the certification audit for the first time. The auditors of Bureau Veritas Certification Rus JSC assessed both the effectiveness of compliance management according to the standard, and also underlined the importance of common methodologies and processes in compliance in the Moscow Exchange Group. Moscow Exchange also successfully passed an independent audit and received a certificate confirming compliance of its corporate compliance system with ISO 37301:2021 Compliance Management System. The audit covered the following areas:

- exercising internal control of licensed activities;

- countering the legalisation (laundering) of the proceeds of crime and the financing of terrorism;

- countering the misuse of inside information and market manipulation;

- monitoring compliance with the tax legislation, including international legislation (CRS, FATCA)

- anti-corruption;

- settlement of conflicts of interest;

- economic restrictions.

- internal compliance involves ensuring that the activities of the Group’s companies comply with mandatory and voluntary requirements;

- external consists of two aspects: 1) formalisation of compliance requirements for issuers and bidders, and 2) informing market participants of best practices;

- the external compliance includes areas related to: 1) formalisation of requirements for issuers and bidders in the field of compliance; 2) informing market participants about best practices; 3) creation of compliance products for market participants.

“Compliance: Key Trends 2023” conference was held for market participants in 2023. The event looked at trends and modern compliance technologies to improve the quality of regulatory risk management (including solutions based on artificial intelligence).

The Group’s compliance practices

2-16 2-26 406-1

In accordance with the “Three Lines of Defence” model, the Supervisory Board of Moscow Exchange approves the Code of Professional Ethics, reviews reports, and assists in developing the ethics function. The managing director for compliance and business ethics is responsible for ethics and compliance-related issues; he/she is directly subordinate to the chairman of the Executive Board of Moscow Exchange.

The leader of the compliance function may take part in meetings of Moscow Exchange’s management bodies and committees, in risk assessments of new processes and products, and in procurement procedures.

A self-assessment of Moscow Exchange’s compliance system is carried out twice a year; external audits are carried out as part of the annual audit.

Failure by employees to comply with the Code of Professional Ethics and to complete mandatory compliance training affects the results of their annual evaluation.

The Group adheres to the open-door principle: employees are always welcome to ask for clarification, submit questions, or use the compliance portal. Moscow Exchange has an initiative to designate active employees who are interested in self-development and refinement of the Company’s compliance procedures ‘Compliance Ambassadors’. They attend training sessions on topics related to compliance culture, and their initiatives in the field of compliance and ethical behaviour are reviewed and may be accepted.

The Group has designed technological solutions, including a communications channel (the anonymous SpeakUp! hotline—Moscow Exchange own creation) that can be used to report possible instances of corruption or violations of ethical business conduct and law. The latest survey held among the employees of the Moscow Exchange Group shows that 83% of employees are aware of the availability and functionality of the SpeakUp! hotline. All employees are welcome to submit anonymous reports via the hotline and receive a response (applicants are sent a link to a web page where they can check the reaction of the Group’s companies). Moscow Exchange Group adheres to the principle of non-retaliation against employees who report problems.

In addition to the internal channel for employees, the Group has set up an external one for reports of corruption-related issues. Interested parties are welcome to use the hotline on the Moscow Exchange website.

Data on the number of applications received regularly reflected in the Sustainability Report.

In 2023, 3 complaints about cases of discrimination were received. Work on requests was carried out within the established time frame, and the necessary corrective actions were taken.

The rest of the reports were general in nature and contained information about new and possibly unfair practices on financial markets, as well as suggestions for improving processes at companies of the Group. All appeals were processed by the Internal Control and Compliance Department; replies were sent within five business days.

Significant fines and breaches of the law

206-1 205-3 2-27

In 2023, in the Moscow Exchange Group there were no significant fines for such cases as non-compliance with legislation and regulatory requirements, or violation of legislation.

In 2023, no lawsuits (pending or completed during the reporting period) regarding anti-competitive behaviour or violation of antitrust legislation were filed against any companies of Moscow Exchange Group. There have been no confirmed cases of business ethics violations or corruption-related violations against Moscow Exchange Group over the past three years.

Business ethics and anti-corruption

Corporate ethics and anti-corruption measures are important elements of the compliance system, and they are included in Moscow Exchange’s Compliance Programme. These measures are constantly being improved in order to enhance the efficiency of operational processes, including by preparing reliable reporting, ensuring compliance with applicable laws, and developing a culture of trust in relations with employees and counterparties.

The Group adheres to the principles of staff involvement in achieving zero tolerance of corruption, avoiding conflicts of interest, and ensuring that actions and procedures are proportional to the level of risks identified during periodic risk assessments.

205-2

As part of implementing the zero-tolerance principle, Moscow Exchange Group takes corruption prevention measures aimed at both internal and external stakeholders, including informing and training employees, developing mechanisms for receiving information on corruption risk events, and including anti-corruption clauses in contracts with counterparties.

The percentage of employees who successfully completed anti-corruption training by the end of 2023 was 99.3%.

In 2023, all members of the Supervisory Board were familiarised with the Policy aimed at preventing corruption offences and the Moscow Exchange Code of Ethics.

The Anti-corruption Policy is publicly available; all partners and counterparties are informed of the Group’s stance and the availability of the corruption hotline. All counterparties undergo mandatory checks. Compliance experts are involved in negotiating contracts that may entail corruption risks, including at the procurement stage, as well as in sponsorship and charitable activities.

205-1 205-3

The companies of the Group monitor the effectiveness of and control over anti-corruption procedures. Self-assessments of the quality of corruption risk management are carried out regularly; reports are compiled for the Executive Board and the Audit Committee under the Supervisory Board of Moscow Exchange. Corruption risk assessments are conducted at all 100% of the Group’s companies. In 2023, no incidents of corruption or violations of the Code of Professional Ethics were registered. No significant corruption risks were identified, either.

Interaction with suppliers

414-1

The Group’s companies have transparent conditions for suppliers and contractors who wish to participate in the procurement process through bids and transactions. Guided by internal regulations such as the regulations on procurement, the Group’s companies guarantee the fulfilment of their contractual obligations. All contracts with suppliers and contractors include an anti-corruption clause, so it can be stated that 100% of business partners are informed about the organisation’s anti-corruption policies and methods.

In 2023 in order to improve the business environment and reduce risks in the supply chain organisational and methodological acitvites were held including the total renewal of the procurement team; the adoption of the Memorandum of Service Level for internal customers; introduction of category-based procurement management system and the adoption of significant amendments to the Procurement Regulations in order to incorporate common for industry market leaders methodologies and generally accepted procurement practices. The final phase is the process of automating the entire process from planning and demand to delivery (end-to-end).

The following corporate governance tasks have been set for 2024: To expand the scope of work and assist employees in the area of compliance, the Group’s companies have set the following objectives: To implement ESG principles throughout the supply chain, Moscow Exchange Group is planning to take the following actions:

- conducting assessment of the Supervisory Board’s effectiveness;

- determine a pool of successors for the members of the Supervisory Board;

- formalize the Group’s management system.

- implement initiatives in accordance with the Compliance Roadmap;

- take measures to develop risk and compliance culture.

- approve the Supplier Code and introduce a procedure for signing a document (or a form) confirming that counterparties are familiar with Moscow Exchange’s requirements;

- continue improving the planning, consolidation, and automation of procurement procedures for Moscow Exchange Group.

The Group’s plans for 2024 and the coming years in the areas of internal audit, business ethics, and anti-corruption include continuous work on the Compliance Roadmap, which envisages improving procedures and automating compliance-related risk management processes.